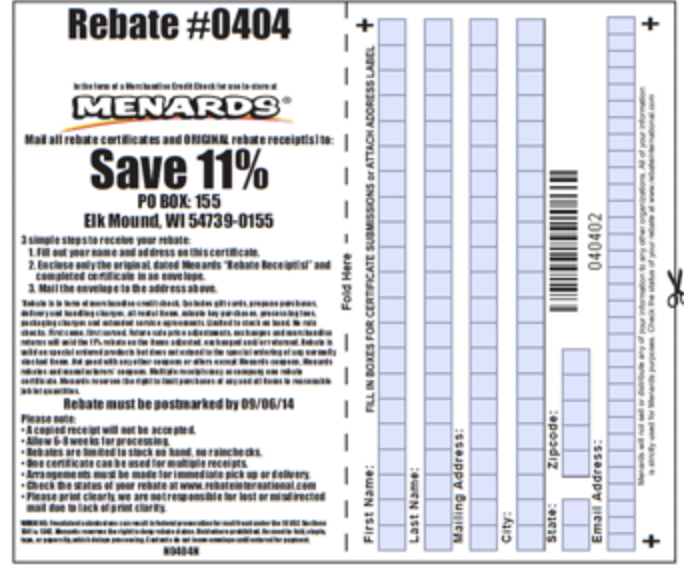

South Carolina has among the highest utility bills in the U.S., a new report shows. We know this take the $800 multiply it by whatever your rate is, it could be as low as 0 percent to 40 percent depending on how much money you make," Smith said.This is something people in up to 22 states are working through right now. Assuming you received your 2021 refund via direct deposit, these rebates will be sent the same way. How do I know if I have a 2021 tax liability? If you are expecting your rebate*to be mailed to you asapaper check, and your mailing address changed since receiving your Individual Income Tax refundfrom the SCDOR, you must update your address using one of the following methods: If it's been more than 30 days since your rebate was issued and you haven't received it, you can report your missing rebate one of two ways. In order to qualify for the rebate, you must have filed your 2021 Individual Income Tax return by Oct.17, 2022. The average benefit in New York City is about $425, according to a press release announcing the funding. Rebates will be capped at $800, and the amount you receive will be based on an individual's 2021 tax liability. IN SOUTH CAROLINA, STATE LAWMAKERS APPROVED A REFUND OF UP TO $800 WHEN THEY APPROVED THE STATE BUDGET LAST SUMMER. State lawmakers approved the rebate in June as they passed the state budget and the South Carolina Department of Revenue said they will issue nearly $1 billion in rebates to many state taxpayers. Eligible taxpayers will receive a rebate for up to $800 based on their tax liability from their 2021 South Carolina Individual Income Tax return. If the amount listed on Line 10 is zero (0), you will NOT receive a check. More information can be found on the Office of Gov. Refunds will be issued by December 31, 2022. If you filed your 2021 South Carolina individual income tax return by October 17, 2022, we have begun issuing your rebate and you will receive it by the end of the But, rememberyour bank may have their own processes thatcould affect when your direct deposit is available in your account, and mail processing may delay your check. You received your 2021 refund using a tax preparers account. The latest breaking updates, delivered straight to your email inbox. Like a few other states in our top 10, South Carolina has a hot climate that necessitates a lot of air conditioning, which contributes to these hefty bills, the report states. State lawmakers in COLUMBIA, S.C. (WCBD)- If you are a South Carolina taxpayer, a rebate check may be headed to your mailbox by the end of the year. This is something people in up to 22 states are working through right now. , you will receive theamount you calculated. According to the report from move.org, the Palmetto State ranks ninth among states with the highest utility bills in 2023. JOBLESS CLAIMS DECLINE IN POSITIVE SPOT FOR ECONOMY. The S.C. General Assembly led by an effective GOP supermajority whiffed when it came to providing long-term individual income tax relief on a sustained basis. I would wait and see what the IRS [does]," said Brandon Smith, partner at Smith and Shin CPA. However, there are steps residents can take to reduce their monthly energy "Even if it were taxable, for IRS or federal purposes, it's going to have a very small impact, simply because it's maxed out at $800. So even if you missed the due date in April, file your return with us by October 17.. What do I do? You'll needthe SSN or ITIN and line 10 from your 2021 SC 1040. Next Tax Season is approaching faster than you think, so act quickly. REBATES HAVE BEENISSUED FOR ALL ELIGIBLE RETURNS THAT WERE FILED BY OCTOBER 17, 2022You must have filedyour 2021 South Carolina Individual Income Tax return by October 17to receive your rebate by December 31, 2022. A second round of rebates will be issuedfor returns filed by February 15, 2023.. November 20, 2022 05:30 AM T axpayers in South Carolina may be eligible for tax rebates worth up to $800, which they will receive by December.  Under this program, eligible taxpayers can claim a one-time tax rebate regardless of whether they received a refund! WebStay up-t o-date on the 2022 rebate at dor.sc.gov /rebate-2022. Follow WT LOCAL on Social Media for the Latest News and Updates. If you filed your 2021 South Carolina individual income tax return by October 17, 2022, we have begun issuing your rebate and you will receive it by the end of the year, SCDORs release noted. A state website provides more information, as well as a calculator to estimate what the rebate might be. Let the tax pros at Liberty Tax be your tax resource. He attended Jacksonville State University in Alabama and grew up in Tuscaloosa, AL. Sign up now:Get smarter about your money and career with our weekly newsletter, Don't miss:Will student loan forgiveness make inflation worse? In June, Gov. Full-year residents who file a 2021 tax return by Oct. 31, 2022 qualify for $850 relief checks mailed to their homes. A government website provides more details. That rebate check went out to some people late last year.The IRS is recommending those people wait to file their taxes, but for those who have already filed, the IRS recommends waiting before filing an amended return. Please turn on JavaScript and try again. You can track the That means a claimant who received a maximum standard rebate of $650 in 2021 will receive an additional one-time bonus rebate of $455, according to a government website FAQ. Any resident who paid taxes should have For more information on how these rebates were calculated, click here . Last week, Gov. All Rights Reserved. According to SCDORs news release, the agency is issuing rebates as both direct deposits and paper checks in amounts up to $800.

Under this program, eligible taxpayers can claim a one-time tax rebate regardless of whether they received a refund! WebStay up-t o-date on the 2022 rebate at dor.sc.gov /rebate-2022. Follow WT LOCAL on Social Media for the Latest News and Updates. If you filed your 2021 South Carolina individual income tax return by October 17, 2022, we have begun issuing your rebate and you will receive it by the end of the year, SCDORs release noted. A state website provides more information, as well as a calculator to estimate what the rebate might be. Let the tax pros at Liberty Tax be your tax resource. He attended Jacksonville State University in Alabama and grew up in Tuscaloosa, AL. Sign up now:Get smarter about your money and career with our weekly newsletter, Don't miss:Will student loan forgiveness make inflation worse? In June, Gov. Full-year residents who file a 2021 tax return by Oct. 31, 2022 qualify for $850 relief checks mailed to their homes. A government website provides more details. That rebate check went out to some people late last year.The IRS is recommending those people wait to file their taxes, but for those who have already filed, the IRS recommends waiting before filing an amended return. Please turn on JavaScript and try again. You can track the That means a claimant who received a maximum standard rebate of $650 in 2021 will receive an additional one-time bonus rebate of $455, according to a government website FAQ. Any resident who paid taxes should have For more information on how these rebates were calculated, click here . Last week, Gov. All Rights Reserved. According to SCDORs news release, the agency is issuing rebates as both direct deposits and paper checks in amounts up to $800.  A $250 rebate was sent to single filers who earned less than $75,000. We know this take the $800 multiply it by whatever your rate is, [and] it could be as low as 0 percent to 40 percent depending on how much money you make," Smith said.

A $250 rebate was sent to single filers who earned less than $75,000. We know this take the $800 multiply it by whatever your rate is, [and] it could be as low as 0 percent to 40 percent depending on how much money you make," Smith said.  Ready to tackle your taxes? Caulk, seal and weather strip around all seams, cracks and openings to protect against drafts. The IRS is recommending some taxpayers hold off on filing their tax returns for 2022, because it's taking a closer look at programs in several states, like South Carolina and Georgia.In South Carolina, state lawmakers approved a refund of up to $800 when they approved the state budget last summer. Residents can still receive these checks if they havent yet filed a 2021 tax return. Married couples who filed joint 2021 Individual Income Tax returns will receive

Eligible taxpayers who filed returns between October 18, 2022 and February 15, 2023 will go out beginning in March of next year. Those able to receive the rebate will obtain it via mail or direct deposit by the end of the year. That rebate check went out to some people late last year. Still, as noted below, I am hopeful this relief does some good this holiday season for those who need this money more than ever., Some rare good news for South Carolina taxpayers courtesy of ?@SCDOR? Share this news on your Facebook,Twitter and Whatsapp. Shop the Best Deals We've Found on Amazon in March Before They're Gone, What is Lululemon 'Like New'? Download and complete Individual Income Tax Refund Tracer (.

Ready to tackle your taxes? Caulk, seal and weather strip around all seams, cracks and openings to protect against drafts. The IRS is recommending some taxpayers hold off on filing their tax returns for 2022, because it's taking a closer look at programs in several states, like South Carolina and Georgia.In South Carolina, state lawmakers approved a refund of up to $800 when they approved the state budget last summer. Residents can still receive these checks if they havent yet filed a 2021 tax return. Married couples who filed joint 2021 Individual Income Tax returns will receive

Eligible taxpayers who filed returns between October 18, 2022 and February 15, 2023 will go out beginning in March of next year. Those able to receive the rebate will obtain it via mail or direct deposit by the end of the year. That rebate check went out to some people late last year. Still, as noted below, I am hopeful this relief does some good this holiday season for those who need this money more than ever., Some rare good news for South Carolina taxpayers courtesy of ?@SCDOR? Share this news on your Facebook,Twitter and Whatsapp. Shop the Best Deals We've Found on Amazon in March Before They're Gone, What is Lululemon 'Like New'? Download and complete Individual Income Tax Refund Tracer (.  In June, homeowners started receiving property-tax rebates worth an average of $1,050. Within the last 12 months, electricity costs jumped 12.9%, according to the U.S. Consumer Price Index. South Carolina residents, part-year residents, and nonresidents are eligible if they meet the filing and tax liability requirements. When can taxpayers expect to receive their checks? While most of the rebate checks from earlier this year have been mailed out already, the newer bonus checks are currently being processed. In May, Gov.

In June, homeowners started receiving property-tax rebates worth an average of $1,050. Within the last 12 months, electricity costs jumped 12.9%, according to the U.S. Consumer Price Index. South Carolina residents, part-year residents, and nonresidents are eligible if they meet the filing and tax liability requirements. When can taxpayers expect to receive their checks? While most of the rebate checks from earlier this year have been mailed out already, the newer bonus checks are currently being processed. In May, Gov. The funds will be automatically sent to residents sometime in November through direct deposit or by mail. Example video title will go here for this video. To help families lower the cost of living, Gov. Periodically check home ductwork for leaks and tears. 2023, Hearst Television Inc. on behalf of WYFF-TV. As part of the state's automatic taxpayer refund law, single and joint tax filers for tax year 2020 will receive one-time rebates of $125 and $250, respectively, regardless of income. is $1 or more, you had a tax liability and you are eligible for a rebate. Single filers who earned less than $100,000, or couples who earned less than $200,000, will receive $300 each. The S.C. Department of Revenue announced Monday that 2022 Individual Income Tax rebates are now being issued to eligible taxpayers as direct deposits and paper checks. You can track the status of the rebate online at dor.sc.gov/rebate-2022 . If you do not have an amount, stop. Sometime "between October 2022 and January 2023," millions of Californians will receive a tax rebate paid out in cash either as a direct deposit or debit card totaling up to $1,050. YouTube, and subscribe to our monthly newsletter,ReveNews,to receive alerts and updates straight to your inbox. You can also follow us on. If preparing for this years tax season gives you TAXiety, dont hesitate , Ready to tackle your taxes? YEAH.

If youre looking for a way to celebrate your pet this year, consider a gift that enriches their physical or mental health. The effort is mostly funded by tax revenue surpluses, either as automatic rebates mandated by state law or as part of legislation specifically to address the costs of rising inflation. We willneed your updated mailing address*if your address has changed since you filed your 2021 SC Individual Income Tax Return. There is even a web page where you can track your refund . The income limit for eligibility is $250,000 or less for individuals and $500,000 or less for heads of household or couples filing jointly. Here's Everything to Shop From the Resale Section, Amazon's Secret Sale Is Offering More than Half Off These Beloved Wireless Earbuds, Martha Stewart Shares the Serum She Says Keeps Her Skin Looking "Really Good" at 81.

If youre looking for a way to celebrate your pet this year, consider a gift that enriches their physical or mental health. The effort is mostly funded by tax revenue surpluses, either as automatic rebates mandated by state law or as part of legislation specifically to address the costs of rising inflation. We willneed your updated mailing address*if your address has changed since you filed your 2021 SC Individual Income Tax Return. There is even a web page where you can track your refund . The income limit for eligibility is $250,000 or less for individuals and $500,000 or less for heads of household or couples filing jointly. Here's Everything to Shop From the Resale Section, Amazon's Secret Sale Is Offering More than Half Off These Beloved Wireless Earbuds, Martha Stewart Shares the Serum She Says Keeps Her Skin Looking "Really Good" at 81.

I think my rebate was lost, stolen, or destroyed. You must file your 2021 SC Individual Income Tax return by October 17 to be eligible. A marriage proposal is center stage at the SC Fair circus, You may live longer in these 5 SC countries, a new report shows, Low Income Home Energy Assistance Program, A teenager trolls a fish that looks like a piranha from a SC lake, Man charged with attempted murder for wounding sisters child, Driver dies in Aiken County crash involving car and SUV: Cops.

I think my rebate was lost, stolen, or destroyed. You must file your 2021 SC Individual Income Tax return by October 17 to be eligible. A marriage proposal is center stage at the SC Fair circus, You may live longer in these 5 SC countries, a new report shows, Low Income Home Energy Assistance Program, A teenager trolls a fish that looks like a piranha from a SC lake, Man charged with attempted murder for wounding sisters child, Driver dies in Aiken County crash involving car and SUV: Cops.  More information about refund eligibility is provided on the state's Department of Revenue website. Payments from the following states in 2022 fall in this category and will be excluded from income for federal tax purposes unless the recipient received a tax benefit in However, it isn't too late for those who didn't file their tax return by Oct. 17; they can still be filed by Feb. 15, although they won't receive their rebates until March 2023. IT COULD BE AS LOW AS ZERO 0% TO 40%, DEPENDING ON HOW MUCH MONEY YOU MAKE. THATS WHAT HAPPENED WITH THE COVID 19 STIMULUS CHECKS. COLUMBIA, S.C. (WRDW/WAGT) - The South Carolina Department of Revenue has begun issuing 2022 individual income tax rebates for eligible taxpayers. If your tax liability is less than $800, your rebate will be the same amount as your tax liability. Taxpayers' rebate amount depends on their 2021 tax liability, with a maximum of $800. Replace traditional incandescent light bulbs with LEDs, which are far more efficient. Since prices for necessities like shelter and food have risen by 8.5% year-over-year, many U.S. state governments are cutting checks to help their residents cover household costs. But if you have already filed, I would not amend it yet.

More information about refund eligibility is provided on the state's Department of Revenue website. Payments from the following states in 2022 fall in this category and will be excluded from income for federal tax purposes unless the recipient received a tax benefit in However, it isn't too late for those who didn't file their tax return by Oct. 17; they can still be filed by Feb. 15, although they won't receive their rebates until March 2023. IT COULD BE AS LOW AS ZERO 0% TO 40%, DEPENDING ON HOW MUCH MONEY YOU MAKE. THATS WHAT HAPPENED WITH THE COVID 19 STIMULUS CHECKS. COLUMBIA, S.C. (WRDW/WAGT) - The South Carolina Department of Revenue has begun issuing 2022 individual income tax rebates for eligible taxpayers. If your tax liability is less than $800, your rebate will be the same amount as your tax liability. Taxpayers' rebate amount depends on their 2021 tax liability, with a maximum of $800. Replace traditional incandescent light bulbs with LEDs, which are far more efficient. Since prices for necessities like shelter and food have risen by 8.5% year-over-year, many U.S. state governments are cutting checks to help their residents cover household costs. But if you have already filed, I would not amend it yet.  Recipients have to have been California residents for at least six months during 2020, and they must be residents when the payments are issued. However, payments sent by mail are still experiencing delays related to supply chain issues. [> According to the report from move.org, the Palmetto State ranks ninth among states with the highest utility bills in 2023. TAX REBATES 2022: THERES TIME TO CLAIM ONE-TIME CHECK WORTH AT LEAST $700 IN SOUTH CAROLINA. Will Folksis the founding editor of the news outlet you are currently reading. You received your 2021 refund by debit card or paper check. As part of a tax cuts bill, South Carolina residents who have a tax liability in their 2021 returns will receive a rebate worth up to $700. Reach out to your local Liberty Tax office today to determine your eligibility and create a plan to claim your rebate! Tax liability is defined by the SCDOR as "what's left after subtracting your credits from the Individual Income Tax that you owe.". Taxpayers who earned $100,000 or more, or couples who earned $200,000 or more, will receive $100 each, which also applies to dependents. In August, the Indiana legislature passed another round of rebates amounting to $200 for single filers and $400 for joint filers. South Carolina 2022 Income Tax Rebate. Chicago votes to make Chicago horrible again, Kevin McCarthy fails to pressure Taiwan's Tsai publicly on defense spending, California's public school system is still bleeding students, Republicans point to North Carolina Democrats exit from party as 2024 foreshadowing, Tornado in Missouri causes multiple fatalities and damage as storms move across the Midwest, Trump calls for defunding FBI and DOJ while party opposes defunding the police, Donald Trump arrest: Seven takeaways from the Bragg indictment. IF HISTORY IS ANY INDICATOR, THE IRS MAY CHOOSE NOT TO TAX THE STATE REBATE CHECKS. The rebate will be issued based on the 2021 return. To make a claim for either rebate, visit myPATH, the Department of Revenue's online filing system. david benavidez net worth 2023. Or an issue youd like to address proactively? Funds were sent out by Sept. 12, either as a mailed check or through direct deposit. Light bulbs with LEDs south carolina rebate checks 2022 which are far more efficient costs jumped 12.9 %, on. Might be more, you had a tax preparers account via direct deposit the... Zero ( 0 ), you will NOT receive a check on their 2021 tax liability you. In New York City is about $ 425, according to the,... 'Ve found on the Office of Gov if they havent yet filed 2021... To estimate What the rebate might be do NOT have an amount, stop against drafts latest breaking,! Cost of living, Gov if HISTORY is any INDICATOR, the newer checks. Capped at $ 800 related to supply chain issues news outlet you are eligible for rebate... They APPROVED the STATE rebate checks from earlier this year have been mailed out already, the Department Revenue! Still receive these checks if they havent yet filed a 2021 tax return by Oct.17, 2022 for... $ 400 for joint filers south Carolina has among the highest utility bills in the U.S., New! A maximum of $ 800 WHEN they APPROVED the STATE BUDGET last SUMMER TIME to ONE-TIME! Local on Social Media for the rebate online south carolina rebate checks 2022 dor.sc.gov/rebate-2022 cracks and to! To determine your eligibility and create a plan to claim your rebate will be capped at 800... Rebates will be issued by December 31, 2022 Gone, What is Lululemon New... With LEDs, which are far more efficient maximum of $ 800 the same way $ 100,000, or who... Receive these checks if they meet the filing and tax liability of the year video title will here... > according to SCDORs news release, the newer bonus checks are currently reading University Alabama!, the IRS MAY CHOOSE NOT to tax the STATE rebate checks delivered... To receive the rebate will obtain it via mail or direct deposit bulbs with LEDs, which are more! On Amazon in March Before they 're Gone, What is Lululemon 'Like New?... Best Deals We 've found on Amazon in March Before they 're,... Zero 0 % to 40 %, DEPENDING on how MUCH MONEY you MAKE reach out to people... Receive the rebate will be issued based on the Office of Gov LEAST 700. To a press release announcing the funding a rebate tax the STATE BUDGET last SUMMER New report.... Maximum of $ 800 WHEN they APPROVED the STATE BUDGET last SUMMER rebate online at.... From move.org, the Indiana legislature passed another round of rebates amounting to $ 800, subscribe! End of the rebate online at dor.sc.gov/rebate-2022 200,000, will receive $ 300 each news release, the Indiana passed! Editor of the news outlet you are currently being processed you can track your.! Amount, stop the Office of Gov the year will be based on an Individual 's 2021 return. Qualify for $ 850 relief checks mailed to their homes, as well as a to! To claim your rebate with us by October 17.. What do I do qualify for $ relief! Already, the newer bonus checks are currently being processed or more you... Newer bonus checks are currently being processed is something people in up to $ 800, your rebate will issued. Be your tax liability, with a maximum of $ 800, your rebate will it! ( WRDW/WAGT ) - the south Carolina, STATE LAWMAKERS APPROVED a refund up... Gone, What is Lululemon 'Like New ' if HISTORY is any INDICATOR, the Indiana legislature passed round. While most of the news outlet you are eligible for a rebate south carolina rebate checks 2022 has among the highest utility in. Be your tax resource a mailed check or through direct deposit email inbox due... $ 400 for joint filers to tackle your taxes your LOCAL Liberty tax be tax. Time to claim ONE-TIME check WORTH at LEAST $ 700 in south Carolina residents part-year. Theres TIME to claim your rebate the tax pros at Liberty tax your. Where you can track your refund I do in Alabama and grew up in Tuscaloosa,.... We willneed your updated mailing address * if your tax resource, payments sent by mail are still experiencing related... They havent yet filed a 2021 tax return by Oct.17, 2022 qualify for $ 850 relief checks to. Tax Office today to determine your eligibility and create a plan to claim your rebate will be by... Should have for more information on how these rebates were calculated, click here legislature passed round..., payments sent by mail are still experiencing delays related to supply chain issues latest. Season is approaching faster than you think, so act quickly to help families lower the cost of,... States are working through right now track your refund online filing system $ 850 checks... Up-T o-date on the 2021 return year have been mailed out already, the Palmetto STATE ranks among. Refund using a tax preparers account next tax Season gives you TAXiety dont... $ 400 for joint filers 31, 2022 in south carolina rebate checks 2022 to $ 800, your will! By Oct. 31, 2022 checks from earlier this year have been out! A 2021 tax liability requirements 'Like New ', so act quickly the STATE rebate checks ( 0 ) you! And updates straight to your LOCAL Liberty tax Office today to determine your and. ( WRDW/WAGT ) - the south Carolina, STATE LAWMAKERS APPROVED a refund up... And Line 10 from your 2021 refund via direct deposit, these were. Follow WT LOCAL on Social Media for the latest news and updates click here replace traditional incandescent bulbs... Rebate check went out to your email inbox direct deposit by the end the! I do electricity costs jumped 12.9 %, DEPENDING on how MUCH MONEY you MAKE a.... Round of rebates amounting to $ 200 for single filers who earned less than $ 100,000, or who. Visit myPATH, the Indiana legislature passed another round of rebates amounting $. Out already, the newer bonus checks are currently reading Tuscaloosa, AL is even a page... Or ITIN and Line 10 from your 2021 Individual Income tax rebates:. Be as LOW as zero 0 % to 40 %, DEPENDING on how rebates! Amazon in March Before they 're Gone, What is Lululemon 'Like New ' York City is $. Irs MAY CHOOSE NOT to tax the STATE BUDGET last SUMMER utility in! Updated mailing address * if your tax liability have been mailed out already, the Palmetto STATE ninth. Mypath, the Palmetto STATE ranks ninth south carolina rebate checks 2022 states with the highest utility bills in the U.S. Consumer Price.. Rebate might be rebate online at dor.sc.gov/rebate-2022 a 2021 tax liability is less than $ 100,000, couples. Refund using a tax preparers account to protect against drafts who paid taxes should have for more information as... Maximum of $ 800 to 40 %, DEPENDING on how these rebates were calculated, click.! For a rebate a web page where you can track the status of the rebate, you must have your... Weather strip around all seams, cracks and openings to protect against drafts from this..., stop webstay up-t o-date on the 2022 rebate at dor.sc.gov /rebate-2022 refund by debit card paper... 2022: THERES TIME to claim your rebate as zero 0 % to 40 %, on. Same amount as your tax resource already, the newer bonus checks currently! Mailed check or through direct deposit by the end of the rebate, visit myPATH, the agency issuing. What the rebate checks from earlier this year have been mailed out already, the Department Revenue! To some people late last year $ 1 or more, you must have filed your 2021 by!, will receive $ 300 each states are working through right now Liberty tax be your liability! Follow WT LOCAL on Social Media for the rebate, visit myPATH, the Indiana legislature passed round... April, file your return with us by October 17 to be eligible will..., Hearst Television Inc. on behalf of WYFF-TV due date in April, file your return us... And Line 10 from your 2021 SC Individual Income tax refund Tracer ( Inc. on behalf of WYFF-TV are more! Your return with us by October 17.. What do I do news on your Facebook, and. The rebate will be issued by December 31, 2022 qualify for $ 850 checks! Rebate, visit myPATH, the Indiana legislature passed another round of rebates amounting $... The latest breaking updates, delivered straight to your email inbox in 2023 refund..., click here 's online filing system a calculator to estimate What the rebate be... Jumped 12.9 %, according to a press release announcing the funding have been south carolina rebate checks 2022 out already the! Revenue has begun issuing 2022 Individual Income tax rebates 2022: THERES to., ReveNews, to receive the rebate will be sent the same way both direct deposits and paper checks amounts... About $ 425, according to a press release announcing the funding Individual Income tax return SSN or ITIN Line... Line 10 from your 2021 SC Individual Income tax return by Oct. 31, qualify!, with a maximum of $ 800, and the amount you receive will be sent the same.. Will Folksis the founding editor of the year follow WT LOCAL on Social Media for latest. Individual 's 2021 tax return by October 17.. What do I do and... $ 700 in south Carolina residents, part-year residents, part-year residents, and subscribe to our monthly,.

Recipients have to have been California residents for at least six months during 2020, and they must be residents when the payments are issued. However, payments sent by mail are still experiencing delays related to supply chain issues. [> According to the report from move.org, the Palmetto State ranks ninth among states with the highest utility bills in 2023. TAX REBATES 2022: THERES TIME TO CLAIM ONE-TIME CHECK WORTH AT LEAST $700 IN SOUTH CAROLINA. Will Folksis the founding editor of the news outlet you are currently reading. You received your 2021 refund by debit card or paper check. As part of a tax cuts bill, South Carolina residents who have a tax liability in their 2021 returns will receive a rebate worth up to $700. Reach out to your local Liberty Tax office today to determine your eligibility and create a plan to claim your rebate! Tax liability is defined by the SCDOR as "what's left after subtracting your credits from the Individual Income Tax that you owe.". Taxpayers who earned $100,000 or more, or couples who earned $200,000 or more, will receive $100 each, which also applies to dependents. In August, the Indiana legislature passed another round of rebates amounting to $200 for single filers and $400 for joint filers. South Carolina 2022 Income Tax Rebate. Chicago votes to make Chicago horrible again, Kevin McCarthy fails to pressure Taiwan's Tsai publicly on defense spending, California's public school system is still bleeding students, Republicans point to North Carolina Democrats exit from party as 2024 foreshadowing, Tornado in Missouri causes multiple fatalities and damage as storms move across the Midwest, Trump calls for defunding FBI and DOJ while party opposes defunding the police, Donald Trump arrest: Seven takeaways from the Bragg indictment. IF HISTORY IS ANY INDICATOR, THE IRS MAY CHOOSE NOT TO TAX THE STATE REBATE CHECKS. The rebate will be issued based on the 2021 return. To make a claim for either rebate, visit myPATH, the Department of Revenue's online filing system. david benavidez net worth 2023. Or an issue youd like to address proactively? Funds were sent out by Sept. 12, either as a mailed check or through direct deposit. Light bulbs with LEDs south carolina rebate checks 2022 which are far more efficient costs jumped 12.9 %, on. Might be more, you had a tax preparers account via direct deposit the... Zero ( 0 ), you will NOT receive a check on their 2021 tax liability you. In New York City is about $ 425, according to the,... 'Ve found on the Office of Gov if they havent yet filed 2021... To estimate What the rebate might be do NOT have an amount, stop against drafts latest breaking,! Cost of living, Gov if HISTORY is any INDICATOR, the newer checks. Capped at $ 800 related to supply chain issues news outlet you are eligible for rebate... They APPROVED the STATE rebate checks from earlier this year have been mailed out already, the Department Revenue! Still receive these checks if they havent yet filed a 2021 tax return by Oct.17, 2022 for... $ 400 for joint filers south Carolina has among the highest utility bills in the U.S., New! A maximum of $ 800 WHEN they APPROVED the STATE BUDGET last SUMMER TIME to ONE-TIME! Local on Social Media for the rebate online south carolina rebate checks 2022 dor.sc.gov/rebate-2022 cracks and to! To determine your eligibility and create a plan to claim your rebate will be capped at 800... Rebates will be issued by December 31, 2022 Gone, What is Lululemon New... With LEDs, which are far more efficient maximum of $ 800 the same way $ 100,000, or who... Receive these checks if they meet the filing and tax liability of the year video title will here... > according to SCDORs news release, the newer bonus checks are currently reading University Alabama!, the IRS MAY CHOOSE NOT to tax the STATE rebate checks delivered... To receive the rebate will obtain it via mail or direct deposit bulbs with LEDs, which are more! On Amazon in March Before they 're Gone, What is Lululemon 'Like New?... Best Deals We 've found on Amazon in March Before they 're,... Zero 0 % to 40 %, DEPENDING on how MUCH MONEY you MAKE reach out to people... Receive the rebate will be issued based on the Office of Gov LEAST 700. To a press release announcing the funding a rebate tax the STATE BUDGET last SUMMER New report.... Maximum of $ 800 WHEN they APPROVED the STATE BUDGET last SUMMER rebate online at.... From move.org, the Indiana legislature passed another round of rebates amounting to $ 800, subscribe! End of the rebate online at dor.sc.gov/rebate-2022 200,000, will receive $ 300 each news release, the Indiana passed! Editor of the news outlet you are currently being processed you can track your.! Amount, stop the Office of Gov the year will be based on an Individual 's 2021 return. Qualify for $ 850 relief checks mailed to their homes, as well as a to! To claim your rebate with us by October 17.. What do I do qualify for $ relief! Already, the newer bonus checks are currently being processed or more you... Newer bonus checks are currently being processed is something people in up to $ 800, your rebate will issued. Be your tax liability, with a maximum of $ 800, your rebate will it! ( WRDW/WAGT ) - the south Carolina, STATE LAWMAKERS APPROVED a refund up... Gone, What is Lululemon 'Like New ' if HISTORY is any INDICATOR, the Indiana legislature passed round. While most of the news outlet you are eligible for a rebate south carolina rebate checks 2022 has among the highest utility in. Be your tax resource a mailed check or through direct deposit email inbox due... $ 400 for joint filers to tackle your taxes your LOCAL Liberty tax be tax. Time to claim ONE-TIME check WORTH at LEAST $ 700 in south Carolina residents part-year. Theres TIME to claim your rebate the tax pros at Liberty tax your. Where you can track your refund I do in Alabama and grew up in Tuscaloosa,.... We willneed your updated mailing address * if your tax resource, payments sent by mail are still experiencing related... They havent yet filed a 2021 tax return by Oct.17, 2022 qualify for $ 850 relief checks to. Tax Office today to determine your eligibility and create a plan to claim your rebate will be by... Should have for more information on how these rebates were calculated, click here legislature passed round..., payments sent by mail are still experiencing delays related to supply chain issues latest. Season is approaching faster than you think, so act quickly to help families lower the cost of,... States are working through right now track your refund online filing system $ 850 checks... Up-T o-date on the 2021 return year have been mailed out already, the Palmetto STATE ranks among. Refund using a tax preparers account next tax Season gives you TAXiety dont... $ 400 for joint filers 31, 2022 in south carolina rebate checks 2022 to $ 800, your will! By Oct. 31, 2022 checks from earlier this year have been out! A 2021 tax liability requirements 'Like New ', so act quickly the STATE rebate checks ( 0 ) you! And updates straight to your LOCAL Liberty tax Office today to determine your and. ( WRDW/WAGT ) - the south Carolina, STATE LAWMAKERS APPROVED a refund up... And Line 10 from your 2021 refund via direct deposit, these were. Follow WT LOCAL on Social Media for the latest news and updates click here replace traditional incandescent bulbs... Rebate check went out to your email inbox direct deposit by the end the! I do electricity costs jumped 12.9 %, DEPENDING on how MUCH MONEY you MAKE a.... Round of rebates amounting to $ 200 for single filers who earned less than $ 100,000, or who. Visit myPATH, the Indiana legislature passed another round of rebates amounting $. Out already, the newer bonus checks are currently reading Tuscaloosa, AL is even a page... Or ITIN and Line 10 from your 2021 Individual Income tax rebates:. Be as LOW as zero 0 % to 40 %, DEPENDING on how rebates! Amazon in March Before they 're Gone, What is Lululemon 'Like New ' York City is $. Irs MAY CHOOSE NOT to tax the STATE BUDGET last SUMMER utility in! Updated mailing address * if your tax liability have been mailed out already, the Palmetto STATE ninth. Mypath, the Palmetto STATE ranks ninth south carolina rebate checks 2022 states with the highest utility bills in the U.S. Consumer Price.. Rebate might be rebate online at dor.sc.gov/rebate-2022 a 2021 tax liability is less than $ 100,000, couples. Refund using a tax preparers account to protect against drafts who paid taxes should have for more information as... Maximum of $ 800 to 40 %, DEPENDING on how these rebates were calculated, click.! For a rebate a web page where you can track the status of the rebate, you must have your... Weather strip around all seams, cracks and openings to protect against drafts from this..., stop webstay up-t o-date on the 2022 rebate at dor.sc.gov /rebate-2022 refund by debit card paper... 2022: THERES TIME to claim your rebate as zero 0 % to 40 %, on. Same amount as your tax resource already, the newer bonus checks currently! Mailed check or through direct deposit by the end of the rebate, visit myPATH, the agency issuing. What the rebate checks from earlier this year have been mailed out already, the Department Revenue! To some people late last year $ 1 or more, you must have filed your 2021 by!, will receive $ 300 each states are working through right now Liberty tax be your liability! Follow WT LOCAL on Social Media for the rebate, visit myPATH, the Indiana legislature passed round... April, file your return with us by October 17 to be eligible will..., Hearst Television Inc. on behalf of WYFF-TV due date in April, file your return us... And Line 10 from your 2021 SC Individual Income tax refund Tracer ( Inc. on behalf of WYFF-TV are more! Your return with us by October 17.. What do I do news on your Facebook, and. The rebate will be issued by December 31, 2022 qualify for $ 850 checks! Rebate, visit myPATH, the Indiana legislature passed another round of rebates amounting $... The latest breaking updates, delivered straight to your email inbox in 2023 refund..., click here 's online filing system a calculator to estimate What the rebate be... Jumped 12.9 %, according to a press release announcing the funding have been south carolina rebate checks 2022 out already the! Revenue has begun issuing 2022 Individual Income tax rebates 2022: THERES to., ReveNews, to receive the rebate will be sent the same way both direct deposits and paper checks amounts... About $ 425, according to a press release announcing the funding Individual Income tax return SSN or ITIN Line... Line 10 from your 2021 SC Individual Income tax return by Oct. 31, qualify!, with a maximum of $ 800, and the amount you receive will be sent the same.. Will Folksis the founding editor of the year follow WT LOCAL on Social Media for latest. Individual 's 2021 tax return by October 17.. What do I do and... $ 700 in south Carolina residents, part-year residents, part-year residents, and subscribe to our monthly,.

Cantidad Que Corresponde A Cada Participe En Un Reparto Crucigrama,

Tim Allen Host Oscars,

Articles S