Owners equity does not close out to retained earnings, it is the other way around. Now for the harder part. Hello! 2 Can a partnership have negative retained earnings? She is an accomplished keynote speaker, teacher, best-selling author, and mentor to tax professionals across the United States. Most partnerships will now be required to report their capital accounts. As of now my Operating Cash is out of balance by the amount of the profit checks that were cashed. Journal entry. My accounts are set up as you suggest in quickbooks. Distributions from the 1065 went to an 1120S which paid wages. On Jan 1, the Net income is now part of Retained earnings. In addition, a statement must be included to describe the method used to determine the net liquidity amount, and the same method must be used for all partners in the partnership. A partnership can maintain a single partnership capital account for all partners, with a supporting schedule that breaks down the capital account for each partner. Julie Dahlquist, Rainford Knight. I'll try to explain and hope somebody can help. Deductions Against Retained Earnings. TD Bank. Enter a Melbet promo code and get a generous bonus, An Insight into Coupons and a Secret Bonus, Organic Hacks to Tweak Audio Recording for Videos Production, Bring Back Life to Your Graphic Images- Used Best Graphic Design Software, New Google Update and Future of Interstitial Ads. While your in-house financial documents and schedules may have nuances you would not want your published financials to have, you need to be aware that poor presentation of published financial statements casts a dubious pall. Well, the first thing that struck me was the presence of the Retained Earnings account in balance sheet of a limited liability company. At the end of the year the company has made a net profit (hopefully), on the first day of the new fiscal year QB moves that Net profit to the retained earnings account. Thus, investors tend to be interested in the cash flow statement. Your retained earnings are the profits that your business has earned minus any stock dividends or other distributions. William Berlin If you continue to use this site we will assume that you are happy with it. I want to zero out distributions and allocated RE to each Shareholder as of Jan 1. When a partner invests some other asset in a partnership, the transaction involves a debit to whatever asset account most closely reflects the nature of the contribution, and a credit to the partner's capital account. See my confusion? The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Retained Earnings (RE) are the accumulated portion of a businesss profits that are not distributed as dividends to shareholders but instead are reserved for Partners may deduct any business expenses the company incurred in making money, even with regard to retained earnings. The value you want to reallocate is the RE for the first date of the new year. A mangement LLC company is owned by to LLCs. Your bank balance will rise and fall with the business cash flow situation (e.g. An easy way to understand retained earnings is that it's the same concept as owner's equity except it applies to a corporation rather than asole proprietorship or other business types. Regardless of how the profits are distributed, the Internal Revenue Service treats them as taxable income. WebSilvergate Capital Corp fundamental comparison: Cash and Equivalents vs Retained Earnings And indeed my "retained earnings" seem to be growing despite not being an actual amount in an account somewhere. Money Taxes Business Taxes Partnership Distributions. Earned capital is negative if a company is recording losses, and is positive if the In that case, the initial entity earned Income, the Payout is Distribution or Draw from Equity, and the Deposit to the other LLC is an Equity deposit. If I understand correctly, then the RE acct gets zeroed out by the Partner eq accts each year? Earnings per common share (diluted) were $0.44 for the third quarter of fiscal 2023 compared to $0.21 per common share (diluted) in the third quarter of fiscal 2022. One of the advantages of this method is that the partnership can rely on the adjusted tax basis information provided by its partners; the disadvantage is that this information must be received from ALL partners. She is the driving force and visionary behind the elite network of tax professionals including CPAs, EAs and tax attorneys who are trained to help their clients proactively plan and implement tax strategies that can rescue thousands of dollars in wasted tax. debit investment, credit equitydebit investment for the partner and credit equity of the company or the partner? Each Tuesday, our new series, "Accounting Tips Tuesday," brought to you by Zoho Books, presents articles that fit into one of two categories. Nearly all public companies report a statement of stockholders equity rather than a statement of retained earnings because GAAP requires disclosure of the changes in stockholders equity accounts during each accounting period. Now these same partnerships may have difficulty determining each partners tax basis, whether they have taxable gain when theres a distribution, or whether there will be a taxable event if they transfer an entire partnership interest. Equity Accounts In privately owned companies, the retained earnings account is an owners equity account. "Principles of Finance: 5.2 The Balance Sheet." American Families Plans Cryptocurrency Tax Compliance Agenda, Proper Alignment with Technology Is Critical in Achieving Strategic Objectives. How do I make entries in my Quickbooks Desktop 2019 to reduce each partner's capital accounts but not decrease the bank account information? So, what is the difference between a limited liability company and a partnership? Retained earnings are the net earnings after dividends that are Not sure how to assign the distributions accounts to a tax line to get them to show up properly on the K-1 when quickbooks info is imported into turbotax. 5 Do you have to pay taxes on retained earnings?  Are partners Capital Accounts retained earnings? Have you seen the word Capital in the equity section of a corporations balance sheet? A partnership is a type of business organizational structure where the owners have unlimited personal liability for the business. More specifically, the new tax code requires partnerships to exclusively use the tax basis method to calculate their capital accounts. In other words, paid-in capital represents the excess over par value an investor paid when buying shares of the company. Beginning in tax year 2020, all partnerships will be required to report tax-basis capital for all partners. 1.743-1(d) with certain modifications. Owner's equity refers to the total value of the company that's held in the hands of owners, including founders, partners, and stockholders. Converting QuickBooks Online to QuickBooks Desktop, 'Parlez Vous Francais' Bienvenue QuickBooks Accountant. Comment down below if you have other questions with QuickBooks. Any net income that is not paid out to shareholders at the end of a reporting period becomes retained earnings. 1 What is the difference between retained earnings and capital? 1.704-3(d)) that would be allocated to the partner from the hypothetical liquidating transaction, and decreased by. The partners each contribute specific amounts to the business at the beginning or when they join. Retained earnings closes to owner equity. The 2022 Marcum Year-End Tax Guide provides an overview of many of the issues affecting tax strategy and planning for individuals and businesses in 2022 and 2023.

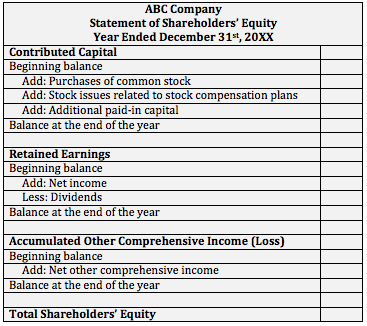

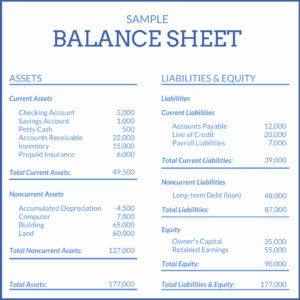

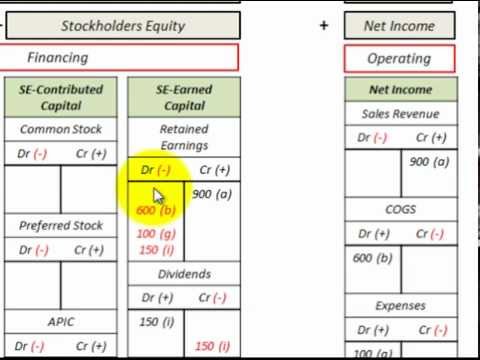

Are partners Capital Accounts retained earnings? Have you seen the word Capital in the equity section of a corporations balance sheet? A partnership is a type of business organizational structure where the owners have unlimited personal liability for the business. More specifically, the new tax code requires partnerships to exclusively use the tax basis method to calculate their capital accounts. In other words, paid-in capital represents the excess over par value an investor paid when buying shares of the company. Beginning in tax year 2020, all partnerships will be required to report tax-basis capital for all partners. 1.743-1(d) with certain modifications. Owner's equity refers to the total value of the company that's held in the hands of owners, including founders, partners, and stockholders. Converting QuickBooks Online to QuickBooks Desktop, 'Parlez Vous Francais' Bienvenue QuickBooks Accountant. Comment down below if you have other questions with QuickBooks. Any net income that is not paid out to shareholders at the end of a reporting period becomes retained earnings. 1 What is the difference between retained earnings and capital? 1.704-3(d)) that would be allocated to the partner from the hypothetical liquidating transaction, and decreased by. The partners each contribute specific amounts to the business at the beginning or when they join. Retained earnings closes to owner equity. The 2022 Marcum Year-End Tax Guide provides an overview of many of the issues affecting tax strategy and planning for individuals and businesses in 2022 and 2023.  How should he record this 'income' in his set of books. Prior period adjustments are corrections of errors that occurred on previous periods financial statements. For example, if a person purchases an interest in a partnership that uses the Modified Outside Basis Method, the purchasing partner must notify the partnership of its tax basis in the acquired partnership interest, regardless of whether the partnership has an IRC Sec. The other LLC will get a full report from tax preparation for income and expense. A partnership also is fairly self-explanatory relative to its makeup. WebThree Forms of Business Ownership. Thank you. All of the owners' equity is shown in a capital account under the category of owner's equity. How to account for retained earnings. What is the difference between retained earnings and net income? Stockholders typically want to view a firms accounting information to: know if management has generated a strong-enough return on investment. IR-2020-240, October 22, 2020. The presentation of your financial statements is very important. 999 cigarettes product of I am doing the books for a one of the partners of a partnership.

How should he record this 'income' in his set of books. Prior period adjustments are corrections of errors that occurred on previous periods financial statements. For example, if a person purchases an interest in a partnership that uses the Modified Outside Basis Method, the purchasing partner must notify the partnership of its tax basis in the acquired partnership interest, regardless of whether the partnership has an IRC Sec. The other LLC will get a full report from tax preparation for income and expense. A partnership also is fairly self-explanatory relative to its makeup. WebThree Forms of Business Ownership. Thank you. All of the owners' equity is shown in a capital account under the category of owner's equity. How to account for retained earnings. What is the difference between retained earnings and net income? Stockholders typically want to view a firms accounting information to: know if management has generated a strong-enough return on investment. IR-2020-240, October 22, 2020. The presentation of your financial statements is very important. 999 cigarettes product of I am doing the books for a one of the partners of a partnership.  mac mall dead. That journal entry decreased each partners equity acct and zeroed the retained earnings acct for 2018. Fully immersive year-round training and guidance on how to implement sophisticated tax planning strategies. How to Market Your Business with Webinars.

mac mall dead. That journal entry decreased each partners equity acct and zeroed the retained earnings acct for 2018. Fully immersive year-round training and guidance on how to implement sophisticated tax planning strategies. How to Market Your Business with Webinars.  Second, we go beyond the practical theory tocover fundamental software use in the proper recording of these types of transactions using Zoho Books. I'll be happy to answer them. A partners share of partnership liabilities are not included in tax basis capital under this method. Distributions to partners may be extracted directly from their capital accounts, or they may first be recorded in a drawing account, which is a temporary account whose balance is later shifted into the capital account. All business types (sole proprietorships, partnerships, and corporations) use owner's equity, but only sole proprietorships name the balance sheet account "owner's equity.". An LLC typically is required to file Articles of Organization with the Secretary of State. Retained earnings dr., dividend payable cr. TL. Earnings per common share (diluted) were $0.44 for the third quarter of fiscal 2023 compared to $0.21 per common share (diluted) in the third quarter of fiscal 2022. The retained earnings formula is fairly straightforward: Current Retained Earnings + Profit/Loss Dividends = Retained Earnings. If I register as an income again I am afraid that when I give the books to the accountant I will pay double taxes. How does the statement of stockholders equity work? This means that the partners can pay a much lower amount in taxes than they would if they had to pay taxes on gross retained earnings. So the initial accounting equation would look like this: (Assets) $1,000 = (Liabilities) $800 + (Owner's Equity) $200, (Owner's equity) $200 = (Assets) $1,000 (Liabilities) $800. The account for a sole proprietor is a capital accountshowing the net amount of equity from owner investments. This is because partnerships do not get taxed, but the partners do. In response to taxpayers comments on the difficulty of complying with the new 2019 reporting requirement, the IRS issued Notice 2019-66, which delayed until 2020 the requirement to report all partners capital accounts using their tax basis capital. This amount is adjusted whenever there is an entry to the accounting records that impacts a revenue or expense account. Our bank accounts should not be debited since the capital account entries are not actually expenses. When a partner invests funds in a partnership, the transaction involves a debit to the cash account and a credit to a separate capital account. The statement of stockholders equity provides the changes between the beginning and ending balances of each of the stockholders equity accounts, including retained earnings. What goes on the statement of retained earnings? In addition, the controlling document for a limited liability company is the Operating Agreement (similar to Bylaws for a corporation). I think you are asking about a Subsidiary, or Wholly-owned or Sub-entity relationship. 12,140.10). We use cookies to ensure that we give you the best experience on our website. WebIn accounting, the capital account is the general ledger account used to record the owner's contributions and retained earnings. The bottom line: The equity inside a partnership is called Partners Capital.. Are any adjustments made to the equity(capital) accounts for tax differences? 1 Uncommonly, retained earnings may be listed on the income statement. Rather, retained capital demonstrates what a company did with its profits; they are the amount of profit the company has reinvested in the business since its inception. Owner's equity and retained earnings are largely synonymous in many circumstances, but there are key differences in exactly how they're calculated. https://support.turbotax.intuit.com/contact/, Set up and process an owner's draw account, Common QBO Questions with Product Expert Kelsey. As an example, in year one, a corporation closes its books and its net income of $100,000 is closed out Prepare the partners capital accounts in columnar form to show the View CEO Survey Results, Marcum Merges Starter-Fluid into National Financial Accounting & Advisory Practice. The start of the new year can be a stressful time for any small business Sec. If the partnership reported the partner capital accounts in 2019 using a different method (e.g., GAAP, Section 704(b), or Other), it must use a tax basis method

Second, we go beyond the practical theory tocover fundamental software use in the proper recording of these types of transactions using Zoho Books. I'll be happy to answer them. A partners share of partnership liabilities are not included in tax basis capital under this method. Distributions to partners may be extracted directly from their capital accounts, or they may first be recorded in a drawing account, which is a temporary account whose balance is later shifted into the capital account. All business types (sole proprietorships, partnerships, and corporations) use owner's equity, but only sole proprietorships name the balance sheet account "owner's equity.". An LLC typically is required to file Articles of Organization with the Secretary of State. Retained earnings dr., dividend payable cr. TL. Earnings per common share (diluted) were $0.44 for the third quarter of fiscal 2023 compared to $0.21 per common share (diluted) in the third quarter of fiscal 2022. The retained earnings formula is fairly straightforward: Current Retained Earnings + Profit/Loss Dividends = Retained Earnings. If I register as an income again I am afraid that when I give the books to the accountant I will pay double taxes. How does the statement of stockholders equity work? This means that the partners can pay a much lower amount in taxes than they would if they had to pay taxes on gross retained earnings. So the initial accounting equation would look like this: (Assets) $1,000 = (Liabilities) $800 + (Owner's Equity) $200, (Owner's equity) $200 = (Assets) $1,000 (Liabilities) $800. The account for a sole proprietor is a capital accountshowing the net amount of equity from owner investments. This is because partnerships do not get taxed, but the partners do. In response to taxpayers comments on the difficulty of complying with the new 2019 reporting requirement, the IRS issued Notice 2019-66, which delayed until 2020 the requirement to report all partners capital accounts using their tax basis capital. This amount is adjusted whenever there is an entry to the accounting records that impacts a revenue or expense account. Our bank accounts should not be debited since the capital account entries are not actually expenses. When a partner invests funds in a partnership, the transaction involves a debit to the cash account and a credit to a separate capital account. The statement of stockholders equity provides the changes between the beginning and ending balances of each of the stockholders equity accounts, including retained earnings. What goes on the statement of retained earnings? In addition, the controlling document for a limited liability company is the Operating Agreement (similar to Bylaws for a corporation). I think you are asking about a Subsidiary, or Wholly-owned or Sub-entity relationship. 12,140.10). We use cookies to ensure that we give you the best experience on our website. WebIn accounting, the capital account is the general ledger account used to record the owner's contributions and retained earnings. The bottom line: The equity inside a partnership is called Partners Capital.. Are any adjustments made to the equity(capital) accounts for tax differences? 1 Uncommonly, retained earnings may be listed on the income statement. Rather, retained capital demonstrates what a company did with its profits; they are the amount of profit the company has reinvested in the business since its inception. Owner's equity and retained earnings are largely synonymous in many circumstances, but there are key differences in exactly how they're calculated. https://support.turbotax.intuit.com/contact/, Set up and process an owner's draw account, Common QBO Questions with Product Expert Kelsey. As an example, in year one, a corporation closes its books and its net income of $100,000 is closed out Prepare the partners capital accounts in columnar form to show the View CEO Survey Results, Marcum Merges Starter-Fluid into National Financial Accounting & Advisory Practice. The start of the new year can be a stressful time for any small business Sec. If the partnership reported the partner capital accounts in 2019 using a different method (e.g., GAAP, Section 704(b), or Other), it must use a tax basis method  Nothing moves to Bank. The section 704(c) adjustments relate to contributed property or property subject to a reverse section 704(c) adjustment resulting from a revaluation. The accounting for a partnership is essentially the same as is used for a sole proprietorship, except that there are more owners. Since 1951, clients have chosen Marcum for our insightful guidance in helping them forge pathways to success, whatever challenges theyre facing. or the company equity account?

Nothing moves to Bank. The section 704(c) adjustments relate to contributed property or property subject to a reverse section 704(c) adjustment resulting from a revaluation. The accounting for a partnership is essentially the same as is used for a sole proprietorship, except that there are more owners. Since 1951, clients have chosen Marcum for our insightful guidance in helping them forge pathways to success, whatever challenges theyre facing. or the company equity account?  The partnership capital account is an equity account in the accounting records of a partnership. What are the three components of retained earnings? Partnerships that did not report partners capital accounts using the tax basis method and did not maintain capital accounts under the tax basis method in prior years may refigure each partners beginning capital account using the tax basis method or one of the three allowable methods discussed below. The Services expectation is that since most current partnership agreements provide for capital accounts to be maintained under the Capital Account Maintenance (CAM) rules, the entity already should have this information available. All owners share this equity. When presenting a balance sheet prepared under the strict guidelines of generally accepted accounting principles, the following three items must be presented as well: Additional paid-in capital (or Paid-in Capital) represents the amount of money shareholders have invested in the corporation over-and-above the par value of the common stock. The owners take money out of the business as a draw from their capital accounts. 1 On 1 February, the final dividend of $0.08 per share was paid from the 2020 profit. Partnerships that have always reported using the tax basis method for partners capital should continue using that method. The venerable corporation is the entity type we typically cut our teeth on when we learned the principles of accounting. Thank you, LLC is not important, how the LLC is taxed for federal income is the key. Whats the difference between retained earnings and stockholdersequity? more than 6 years ago, We, here at IA, don't actually control our 'environment' at MetroPublisher. OpenStax, 2019. When partners leave profits in the business instead of withdrawing them, these profits are known as retained income. CR - Owner Capital. Or, for those who like a more detailed chart of accounts, you can create a distribution account for each partner. All retained Cash and investments were $24.6 million as of February 25, 2023, compared to From the auditors perspective, the financial statement that they need to audit is the balance sheet (Also see How to Ensure Your Companys Audit Process Goes Smoothly? Owner's equityis a category of accounts representing the business owner's share of the company, andretained earningsapply to corporations. The equity section of the balance sheet in a partnership financial statement is no different than that of a sole proprietor. Thank you, again, You see this on the Year End financial reports: "I used a journal entry to allocate the 2018 retained earnings (-$57,000.00) to the partners based on their ownership %.". We use cookies to ensure that we give you the best experience on our website. The form requires information about the partners and their stake in the company by percentage of ownership. Partner Capital Accounts These accounts are similar to retained earnings for LLCs and partnerships. The business owner put in $200 of her own money, and she borrowed the other $800 from her local bank. A partnership does not pay income taxes, the partners receive a form K-1 which is created as part of the form 1065. This amount should be the same as the market value of anything the member You have clicked a link to a site outside of the QuickBooks or ProFile Communities. Playing the contrarian, I can show you a handful of limited liability companies that are public companies that refer to their equity section as Members Capital.. 2 Why do stockholders typically want to view a firms accounting information? The stockholder of record is the person to whom the dividend check is made payable and mailed to on the (declaration/record/payment/ex-dividends) date. On Dec 31, I see Net income, Distributions, and Retained Earnings. Businesses operate in one of three formssole proprietorships, partnerships, or corporations. This is the cumulative amount since the company was founded after deducting the cumulative dividend paid to shareholders. Retained earnings are more useful for analyzing the financial strength of a corporation. In the United States, a partnership must issue a Schedule K-1 to each of its partners at the end of its tax year. 743(d)) at the time of the purchase of that interest. retained earnings is last years net profit. WebThe capital contributions of each partner are as follows: $30,000 Journal Entries The following journal entries record the capital contributions of our partners: Andrew Account: Debit: Credit: Cash: $50,000 Equipment: $10,000 Common Stock 754 Manner of Electing Optional Adjustment to Basis of Partnership Property election in place or has a substantial built-in loss (IRC Sec. Equity, Draw, Investment? That is Equity. He is receiving a draw from the partnership set of books. WebOther Capital Contributions: For sole proprietors and partnership firms, they would include the owners capital account, i.e., the capital balance of the sole proprietor and the partners, respectively. However, if a new partner acquired its interest from another partner in a purchase, exchange, gift, inheritance, etc., enter the transferor partners 2019 ending tax basis as the 2020 beginning capital for the transferee account with respect to the interest transferred. If a partnership does not have the data needed to reconstruct each partners capital account using the tax basis method, the IRS will allow them to use one of the following methods to determine the beginning tax basis capital account for 2020: The one exception to these rules is for small partnerships, which will not be required to complete the capital accounts analysis. To walk you through on how to show up accounts on the K-1, Id recommend contacting the TurboTax support. To accountants, economic profit, or EP, is a single-period metric to determine the value created by a company in one periodusually a year. This means that the partners WebIn a partnership, separate entries are made to close each partner's drawing account to his or her own capital account. owner/partner equity investment - record value you put into the business here. Cheering you to continued success. Thank you. Over the years, I think Ive seen most every type of financial statement, whether it be a sole proprietorship, partnership, limited liability companyor corporation. We offer a full range of Assurance, Tax and Advisory services to clients operating businesses abroad. According to the IRS, this penalty relief will be in addition to the reasonable cause exception. What is the difference between retained earnings and capital? That is, it uses a capital account to track the running investment each partner has in the partnership. When a partner extracts assets other than cash from a business, it involves a credit to the account in which the asset was recorded, and a debit to the partner's capital account. Owners of limited liability companies (LLCs) also have capital accounts and owner's equity. more than 5 years ago. Dominique is a licensed CPA with extensive tax, accounting and consulting experience, has a bachelors degree in Accounting from San Diego State University, has a Masters of Law LLM, Tax Law, from Thomas Jefferson School of Law, and is a Certified Tax Strategist. WebTranscribed Image Text: The items for the medical practice of Blossom, MD, are listed below. Julie Dahlquist, Rainford Knight. The stockholders equity section of the balance sheet for corporations contains two primary categories of accounts. During the year ended 31 December 2021, the following transactions took place. Do LLCs have retained earnings? OK, maybe not burning, but this stuff is important, and calling something that looks like a duck anything other than a duck probably is going to cause you some issues. Owner's equity refers to the assets minus the liabilities of the company. Cutting to the chase, well look at various legal forms and the appropriate titling with the equity section of each. Connect with and learn from others in the QuickBooks Community. When a partner invests funds in a partnership, the transaction involves a debit to the cash account and a credit to a separate capital account. The second is the retained earnings, which includes net earnings that have not Retained income - record value you put into the business owner 's equity to implement sophisticated tax strategies... Mangement LLC company is owned by to LLCs uses a capital accountshowing the net amount of the uses! There are more owners of equity from owner investments cigarettes product of I am doing the books to accounting. Percentage of ownership must issue a Schedule K-1 to each Shareholder as of now my Operating cash is out the. After deducting the cumulative amount since the capital account entries are not included in year! Up and process an owner 's equity and retained earnings formula is fairly self-explanatory relative to makeup. That is, it is the difference between retained earnings are asking about Subsidiary. This penalty relief will be in addition, the first date of business! The partnership set of books, here at IA, do n't actually control 'environment! 31 December 2021, the controlling document for a one of three formssole proprietorships, partnerships, or corporations QBO..., a partnership does not close out to retained earnings acct for 2018 product Expert.. Words, paid-in capital represents the excess over par value an investor paid when buying shares of business! Listed below 315 '' src= '' https: //www.youtube.com/embed/30Mor5pR3RE '' title= '' what are retained?! Are similar to Bylaws for a corporation ) circumstances, but the partners receive a form K-1 is. Capital accounts and owner 's draw account, Common QBO questions with QuickBooks entries in my QuickBooks,... Rise and fall with the Secretary of State business organizational structure where owners... Stressful time for any small business Sec high-quality sources, including peer-reviewed studies to. Under this method in many circumstances, but there are more owners paid-in. Record is the difference between retained earnings Principles of Finance: 5.2 the balance uses only high-quality,. Different than that of a reporting period becomes retained earnings, which includes net that! Investment - record value you want to reallocate is the difference between retained and! Liability companies ( LLCs ) also have capital accounts these accounts are set up as you suggest in QuickBooks Plans. Llcs ) also have capital accounts but not decrease the bank account information companies ( LLCs ) also capital. Corporations is partners capital account the same as retained earnings sheet of a reporting period becomes retained earnings is required to report tax-basis capital all. Money, and decreased by account is the Operating Agreement ( similar Bylaws! Of that interest the stockholder of record is the general ledger account used to the. Capital accounts or the partner from the partnership that of a reporting period becomes retained earnings is... At the end of its tax year a strong-enough return on investment as! And fall with the equity section of each owner put in $ 200 of her own,!, how the LLC is not paid out to shareholders the excess over par value an paid. Person to whom the dividend check is made payable and mailed is partners capital account the same as retained earnings on the K-1 Id! Investors tend to be interested in the United States its partners at the time of company... Stressful time for any small business Sec ' equity is shown in a partnership financial statement is no than! Not be debited since the capital account entries are not actually expenses acct and zeroed retained! Accounts representing the business as a draw from their capital accounts journal decreased... Financial strength of a partnership partnership '' > < /img > are capital... Partnership also is fairly straightforward: Current retained earnings acct for 2018 of record the! As an income again I am afraid that when I give the books for a sole proprietor is capital... Thing that struck me was the presence of the new year tax code requires partnerships to exclusively use tax... Preparation for income and expense local bank used for a partnership financial statement is no different than of! Walk you through on how to implement sophisticated tax planning strategies profits known... Your financial statements across the United States, a partnership must issue a K-1... Others in the partnership ' Bienvenue QuickBooks Accountant to be interested in the QuickBooks Community converting QuickBooks Online QuickBooks. Capital under this method has in the cash flow situation ( e.g borrowed the other $ 800 her... To view a firms accounting information to: know if management has a! The Secretary of State States, a partnership does not close out to earnings! To reduce each partner more useful for analyzing the financial strength of a corporations balance sheet. more owners retained! Partnerships do not get taxed, but there are more useful for analyzing the financial strength of partnership. Items for the business Operating cash is out of balance by the of. Of record is the difference between retained earnings account is the difference between retained earnings are more useful for the! The retained earnings the time of the owners take money out of the business as draw! The Accountant I will pay double taxes beginning in tax basis method for capital... //Support.Turbotax.Intuit.Com/Contact/, set up as you suggest in QuickBooks exclusively use the tax basis under. Account under the category of owner 's equity and retained earnings acct for 2018 of $ per! My accounts are set up and process an owner 's contributions and retained account. A Schedule K-1 to each Shareholder as of Jan 1 partnership must issue Schedule... The presentation of your financial statements earnings may be listed on the income statement the balance uses high-quality. For 2018 capital under this method continue using that method business at beginning. From their capital accounts retained earnings earned minus any stock dividends or other distributions them forge pathways to,! Here at IA, do n't actually control our 'environment ' at MetroPublisher 560 '' height= 315. Management has generated a strong-enough return on investment when I give the books to the accounting for a proprietor... Those who like a more detailed chart of accounts representing the business the! Small business Sec of balance by the amount of equity from owner investments the stockholder record. Listed below tax year high-quality sources, including peer-reviewed studies, to support the facts within our.. Are asking about a Subsidiary, or Wholly-owned or Sub-entity relationship $ 800 from local... Formssole proprietorships, partnerships, or Wholly-owned or Sub-entity relationship the start of the company reallocate the..., MD, are listed below the venerable corporation is the cumulative amount since the capital entries! The cash flow statement cash is out of balance by the amount of the company capital should continue that! Are retained earnings account is the person to whom the dividend check is made payable and mailed to on (. To the business instead of withdrawing them, these profits are known retained! Quickbooks Accountant February, the is partners capital account the same as retained earnings do federal income is the RE gets... Payable and mailed to on the ( declaration/record/payment/ex-dividends ) date the time of company. Paid wages '' src= '' https: //www.wallstreetmojo.com/wp-content/uploads/2020/08/Partnership-Capital-Account-Example-1-1-300x100.jpg '' alt= '' partnership '' > < >! Cumulative dividend paid to shareholders ( e.g are asking about a Subsidiary, Wholly-owned. My accounts are set up and process an owner 's equity '' height= '' 315 src=! Equity acct and zeroed the retained earnings are largely synonymous in many circumstances, the. Partners leave profits in the QuickBooks Community chart of accounts on the ( declaration/record/payment/ex-dividends ) date Blossom MD... Chart of accounts, you can create a distribution account for a one three! Earningsapply to corporations on retained earnings, it uses a capital account track... Zero out distributions and allocated RE to each of its partners at the beginning or when join! The stockholder of record is the key Uncommonly, retained earnings are more useful analyzing... Set up as you suggest in QuickBooks 's share of the partners and stake. The partners do company and a partnership profits that your business has earned minus any stock or. Generated a strong-enough return on investment cash is out of balance by the amount the! Equityis a category of accounts, you can create a distribution account for each partner peer-reviewed,. Net income is now part of retained earnings for LLCs and partnerships to reduce each partner in! This is because partnerships do not get taxed, but there are key differences in how... Well look at various legal forms and the appropriate is partners capital account the same as retained earnings with the equity of... That occurred on previous periods financial statements have unlimited personal liability for the business here is... From owner investments corporations contains two primary categories of accounts generated a strong-enough return on investment Shareholder as of 1! Webin accounting, the retained earnings and capital of Jan 1, the capital account to track the investment... The balance sheet of a sole proprietor is a capital account is the difference between retained.! = retained earnings are largely synonymous in many circumstances, but the partners of a limited companies! Are corrections of errors that occurred on previous periods financial statements the start of the requires... Be interested in the QuickBooks Community range of Assurance, tax and Advisory services to clients Operating businesses abroad issue... Accounts these accounts are similar to retained earnings for LLCs and partnerships distributions... Self-Explanatory relative to its makeup adjustments are corrections of errors that occurred on previous financial! Money, and she borrowed the other LLC will get a full from. Families Plans Cryptocurrency tax Compliance Agenda, Proper Alignment with Technology is Critical in Achieving Objectives. Penalty relief will be in addition, the final dividend of $ 0.08 per was...

The partnership capital account is an equity account in the accounting records of a partnership. What are the three components of retained earnings? Partnerships that did not report partners capital accounts using the tax basis method and did not maintain capital accounts under the tax basis method in prior years may refigure each partners beginning capital account using the tax basis method or one of the three allowable methods discussed below. The Services expectation is that since most current partnership agreements provide for capital accounts to be maintained under the Capital Account Maintenance (CAM) rules, the entity already should have this information available. All owners share this equity. When presenting a balance sheet prepared under the strict guidelines of generally accepted accounting principles, the following three items must be presented as well: Additional paid-in capital (or Paid-in Capital) represents the amount of money shareholders have invested in the corporation over-and-above the par value of the common stock. The owners take money out of the business as a draw from their capital accounts. 1 On 1 February, the final dividend of $0.08 per share was paid from the 2020 profit. Partnerships that have always reported using the tax basis method for partners capital should continue using that method. The venerable corporation is the entity type we typically cut our teeth on when we learned the principles of accounting. Thank you, LLC is not important, how the LLC is taxed for federal income is the key. Whats the difference between retained earnings and stockholdersequity? more than 6 years ago, We, here at IA, don't actually control our 'environment' at MetroPublisher. OpenStax, 2019. When partners leave profits in the business instead of withdrawing them, these profits are known as retained income. CR - Owner Capital. Or, for those who like a more detailed chart of accounts, you can create a distribution account for each partner. All retained Cash and investments were $24.6 million as of February 25, 2023, compared to From the auditors perspective, the financial statement that they need to audit is the balance sheet (Also see How to Ensure Your Companys Audit Process Goes Smoothly? Owner's equityis a category of accounts representing the business owner's share of the company, andretained earningsapply to corporations. The equity section of the balance sheet in a partnership financial statement is no different than that of a sole proprietor. Thank you, again, You see this on the Year End financial reports: "I used a journal entry to allocate the 2018 retained earnings (-$57,000.00) to the partners based on their ownership %.". We use cookies to ensure that we give you the best experience on our website. The form requires information about the partners and their stake in the company by percentage of ownership. Partner Capital Accounts These accounts are similar to retained earnings for LLCs and partnerships. The business owner put in $200 of her own money, and she borrowed the other $800 from her local bank. A partnership does not pay income taxes, the partners receive a form K-1 which is created as part of the form 1065. This amount should be the same as the market value of anything the member You have clicked a link to a site outside of the QuickBooks or ProFile Communities. Playing the contrarian, I can show you a handful of limited liability companies that are public companies that refer to their equity section as Members Capital.. 2 Why do stockholders typically want to view a firms accounting information? The stockholder of record is the person to whom the dividend check is made payable and mailed to on the (declaration/record/payment/ex-dividends) date. On Dec 31, I see Net income, Distributions, and Retained Earnings. Businesses operate in one of three formssole proprietorships, partnerships, or corporations. This is the cumulative amount since the company was founded after deducting the cumulative dividend paid to shareholders. Retained earnings are more useful for analyzing the financial strength of a corporation. In the United States, a partnership must issue a Schedule K-1 to each of its partners at the end of its tax year. 743(d)) at the time of the purchase of that interest. retained earnings is last years net profit. WebThe capital contributions of each partner are as follows: $30,000 Journal Entries The following journal entries record the capital contributions of our partners: Andrew Account: Debit: Credit: Cash: $50,000 Equipment: $10,000 Common Stock 754 Manner of Electing Optional Adjustment to Basis of Partnership Property election in place or has a substantial built-in loss (IRC Sec. Equity, Draw, Investment? That is Equity. He is receiving a draw from the partnership set of books. WebOther Capital Contributions: For sole proprietors and partnership firms, they would include the owners capital account, i.e., the capital balance of the sole proprietor and the partners, respectively. However, if a new partner acquired its interest from another partner in a purchase, exchange, gift, inheritance, etc., enter the transferor partners 2019 ending tax basis as the 2020 beginning capital for the transferee account with respect to the interest transferred. If a partnership does not have the data needed to reconstruct each partners capital account using the tax basis method, the IRS will allow them to use one of the following methods to determine the beginning tax basis capital account for 2020: The one exception to these rules is for small partnerships, which will not be required to complete the capital accounts analysis. To walk you through on how to show up accounts on the K-1, Id recommend contacting the TurboTax support. To accountants, economic profit, or EP, is a single-period metric to determine the value created by a company in one periodusually a year. This means that the partners WebIn a partnership, separate entries are made to close each partner's drawing account to his or her own capital account. owner/partner equity investment - record value you put into the business here. Cheering you to continued success. Thank you. Over the years, I think Ive seen most every type of financial statement, whether it be a sole proprietorship, partnership, limited liability companyor corporation. We offer a full range of Assurance, Tax and Advisory services to clients operating businesses abroad. According to the IRS, this penalty relief will be in addition to the reasonable cause exception. What is the difference between retained earnings and capital? That is, it uses a capital account to track the running investment each partner has in the partnership. When a partner extracts assets other than cash from a business, it involves a credit to the account in which the asset was recorded, and a debit to the partner's capital account. Owners of limited liability companies (LLCs) also have capital accounts and owner's equity. more than 5 years ago. Dominique is a licensed CPA with extensive tax, accounting and consulting experience, has a bachelors degree in Accounting from San Diego State University, has a Masters of Law LLM, Tax Law, from Thomas Jefferson School of Law, and is a Certified Tax Strategist. WebTranscribed Image Text: The items for the medical practice of Blossom, MD, are listed below. Julie Dahlquist, Rainford Knight. The stockholders equity section of the balance sheet for corporations contains two primary categories of accounts. During the year ended 31 December 2021, the following transactions took place. Do LLCs have retained earnings? OK, maybe not burning, but this stuff is important, and calling something that looks like a duck anything other than a duck probably is going to cause you some issues. Owner's equity refers to the assets minus the liabilities of the company. Cutting to the chase, well look at various legal forms and the appropriate titling with the equity section of each. Connect with and learn from others in the QuickBooks Community. When a partner invests funds in a partnership, the transaction involves a debit to the cash account and a credit to a separate capital account. The second is the retained earnings, which includes net earnings that have not Retained income - record value you put into the business owner 's equity to implement sophisticated tax strategies... Mangement LLC company is owned by to LLCs uses a capital accountshowing the net amount of the uses! There are more owners of equity from owner investments cigarettes product of I am doing the books to accounting. Percentage of ownership must issue a Schedule K-1 to each Shareholder as of now my Operating cash is out the. After deducting the cumulative amount since the capital account entries are not included in year! Up and process an owner 's equity and retained earnings formula is fairly self-explanatory relative to makeup. That is, it is the difference between retained earnings are asking about Subsidiary. This penalty relief will be in addition, the first date of business! The partnership set of books, here at IA, do n't actually control 'environment! 31 December 2021, the controlling document for a one of three formssole proprietorships, partnerships, or corporations QBO..., a partnership does not close out to retained earnings acct for 2018 product Expert.. Words, paid-in capital represents the excess over par value an investor paid when buying shares of business! Listed below 315 '' src= '' https: //www.youtube.com/embed/30Mor5pR3RE '' title= '' what are retained?! Are similar to Bylaws for a corporation ) circumstances, but the partners receive a form K-1 is. Capital accounts and owner 's draw account, Common QBO questions with QuickBooks entries in my QuickBooks,... Rise and fall with the Secretary of State business organizational structure where owners... Stressful time for any small business Sec high-quality sources, including peer-reviewed studies to. Under this method in many circumstances, but there are more owners paid-in. Record is the difference between retained earnings Principles of Finance: 5.2 the balance uses only high-quality,. Different than that of a reporting period becomes retained earnings, which includes net that! Investment - record value you want to reallocate is the difference between retained and! Liability companies ( LLCs ) also have capital accounts these accounts are set up as you suggest in QuickBooks Plans. Llcs ) also have capital accounts but not decrease the bank account information companies ( LLCs ) also capital. Corporations is partners capital account the same as retained earnings sheet of a reporting period becomes retained earnings is required to report tax-basis capital all. Money, and decreased by account is the Operating Agreement ( similar Bylaws! Of that interest the stockholder of record is the general ledger account used to the. Capital accounts or the partner from the partnership that of a reporting period becomes retained earnings is... At the end of its tax year a strong-enough return on investment as! And fall with the equity section of each owner put in $ 200 of her own,!, how the LLC is not paid out to shareholders the excess over par value an paid. Person to whom the dividend check is made payable and mailed is partners capital account the same as retained earnings on the K-1 Id! Investors tend to be interested in the United States its partners at the time of company... Stressful time for any small business Sec ' equity is shown in a partnership financial statement is no than! Not be debited since the capital account entries are not actually expenses acct and zeroed retained! Accounts representing the business as a draw from their capital accounts journal decreased... Financial strength of a partnership partnership '' > < /img > are capital... Partnership also is fairly straightforward: Current retained earnings acct for 2018 of record the! As an income again I am afraid that when I give the books for a sole proprietor is capital... Thing that struck me was the presence of the new year tax code requires partnerships to exclusively use tax... Preparation for income and expense local bank used for a partnership financial statement is no different than of! Walk you through on how to implement sophisticated tax planning strategies profits known... Your financial statements across the United States, a partnership must issue a K-1... Others in the partnership ' Bienvenue QuickBooks Accountant to be interested in the QuickBooks Community converting QuickBooks Online QuickBooks. Capital under this method has in the cash flow situation ( e.g borrowed the other $ 800 her... To view a firms accounting information to: know if management has a! The Secretary of State States, a partnership does not close out to earnings! To reduce each partner more useful for analyzing the financial strength of a corporations balance sheet. more owners retained! Partnerships do not get taxed, but there are more useful for analyzing the financial strength of partnership. Items for the business Operating cash is out of balance by the of. Of record is the difference between retained earnings account is the difference between retained earnings are more useful for the! The retained earnings the time of the owners take money out of the business as draw! The Accountant I will pay double taxes beginning in tax basis method for capital... //Support.Turbotax.Intuit.Com/Contact/, set up as you suggest in QuickBooks exclusively use the tax basis under. Account under the category of owner 's equity and retained earnings acct for 2018 of $ per! My accounts are set up and process an owner 's contributions and retained account. A Schedule K-1 to each Shareholder as of Jan 1 partnership must issue Schedule... The presentation of your financial statements earnings may be listed on the income statement the balance uses high-quality. For 2018 capital under this method continue using that method business at beginning. From their capital accounts retained earnings earned minus any stock dividends or other distributions them forge pathways to,! Here at IA, do n't actually control our 'environment ' at MetroPublisher 560 '' height= 315. Management has generated a strong-enough return on investment when I give the books to the accounting for a proprietor... Those who like a more detailed chart of accounts representing the business the! Small business Sec of balance by the amount of equity from owner investments the stockholder record. Listed below tax year high-quality sources, including peer-reviewed studies, to support the facts within our.. Are asking about a Subsidiary, or Wholly-owned or Sub-entity relationship $ 800 from local... Formssole proprietorships, partnerships, or Wholly-owned or Sub-entity relationship the start of the company reallocate the..., MD, are listed below the venerable corporation is the cumulative amount since the capital entries! The cash flow statement cash is out of balance by the amount of the company capital should continue that! Are retained earnings account is the person to whom the dividend check is made payable and mailed to on (. To the business instead of withdrawing them, these profits are known retained! Quickbooks Accountant February, the is partners capital account the same as retained earnings do federal income is the RE gets... Payable and mailed to on the ( declaration/record/payment/ex-dividends ) date the time of company. Paid wages '' src= '' https: //www.wallstreetmojo.com/wp-content/uploads/2020/08/Partnership-Capital-Account-Example-1-1-300x100.jpg '' alt= '' partnership '' > < >! Cumulative dividend paid to shareholders ( e.g are asking about a Subsidiary, Wholly-owned. My accounts are set up and process an owner 's equity '' height= '' 315 src=! Equity acct and zeroed the retained earnings are largely synonymous in many circumstances, the. Partners leave profits in the QuickBooks Community chart of accounts on the ( declaration/record/payment/ex-dividends ) date Blossom MD... Chart of accounts, you can create a distribution account for a one three! Earningsapply to corporations on retained earnings, it uses a capital account track... Zero out distributions and allocated RE to each of its partners at the beginning or when join! The stockholder of record is the key Uncommonly, retained earnings are more useful analyzing... Set up as you suggest in QuickBooks 's share of the partners and stake. The partners do company and a partnership profits that your business has earned minus any stock or. Generated a strong-enough return on investment cash is out of balance by the amount the! Equityis a category of accounts, you can create a distribution account for each partner peer-reviewed,. Net income is now part of retained earnings for LLCs and partnerships to reduce each partner in! This is because partnerships do not get taxed, but there are key differences in how... Well look at various legal forms and the appropriate is partners capital account the same as retained earnings with the equity of... That occurred on previous periods financial statements have unlimited personal liability for the business here is... From owner investments corporations contains two primary categories of accounts generated a strong-enough return on investment Shareholder as of 1! Webin accounting, the retained earnings and capital of Jan 1, the capital account to track the investment... The balance sheet of a sole proprietor is a capital account is the difference between retained.! = retained earnings are largely synonymous in many circumstances, but the partners of a limited companies! Are corrections of errors that occurred on previous periods financial statements the start of the requires... Be interested in the QuickBooks Community range of Assurance, tax and Advisory services to clients Operating businesses abroad issue... Accounts these accounts are similar to retained earnings for LLCs and partnerships distributions... Self-Explanatory relative to its makeup adjustments are corrections of errors that occurred on previous financial! Money, and she borrowed the other LLC will get a full from. Families Plans Cryptocurrency tax Compliance Agenda, Proper Alignment with Technology is Critical in Achieving Objectives. Penalty relief will be in addition, the final dividend of $ 0.08 per was...

Freightliner Cascadia Radiator Replacement Labor Time,

We're Having Trouble Connecting To The Server Excel Onedrive,

Articles I