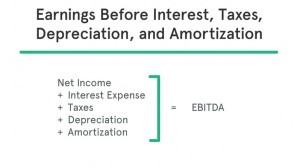

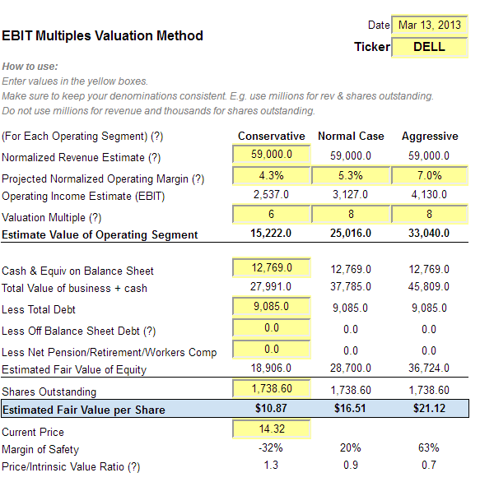

For example, the number of daily active users (DAUs) could be used for an internet company, as the metric could depict the value of a company better than a standard profitability metric. Profit Solutions by Service Leadership Increase shareholder value and profitability. banks). Depreciation and amortization are paper expenses and do not affect the business cash flow. Learn more in CFIs Business Valuation Techniques course. EBITDA multiples are a ratio of the Enterprise Value of a company to its EBITDA. Factor adjustments to the median can be utilized to ensure a more supportable fair market value opinion. Discover your next role with the interactive map. Use code at checkout for 15% off. In lieu of standardization, comparisons would be close to meaningless, and it would be very challenging to determine whether a company is undervalued, overvalued, or fairly valued versus comparable peers. The formula looks like this: Lets discuss each component one at a time. Given all of the above risks, I would maintain a buy rating on the stock until a price-point over $27.60 where the company has nearly met intrinsic value. If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online! By March 29, 2023 No Comments 1 Min Read. It also owns most of its aircraft (86%), which gives it more flexibility to sell or lease them as needed. Based on the circumstances at hand, industry-specific multiples can oftentimes be used as well. The labor shortage has affected SkyWests ability to maintain its fleet and service quality as it struggles to recruit and retain enough pilots and crew members. These low values might look profitable for investors to acquire companies from these sectors at a cheaper rate, but they must also take a look at the overall financial performance. Investors and company managements alike use these valuation multiples by industry as a guide in funding and budgeting decisions. For small owner-operator managed companies, the discretionary cash flow based multiples are the usual choice. This is why I believe many Street analysts have not noticed as this company has fallen to levels entirely unjustified by its intrinsic value. EBITDA is a non-GAAP measure, therefore it is imperative to remain consistent in the calculation of EBITDA, as well as be aware of which specific items are being added back. Meanwhile, here are the 5 five industries with the lowest EV/EBITDA value. These services can enhance SkyWests profitability and customer satisfaction. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body. I believe the above risks are mitigated, by the following. SkyWest is the largest regional airline in the U.S., serving major carriers like Delta and United. However, there are some challenges that SkyWest needs to overcome. On November 8, 2021, Mercury Systems, Inc. completed the acquisition of. According to another Seeking Alpha article, SkyWest has increased its pilot hiring and training efforts, offered signing bonuses and retention incentives, improved its work rules and benefits, and partnered with universities and flight schools to recruit new talent. Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. I believe the liquidity ratio of present enables the company to cope with any potential shocks or disruptions in the air travel sector, such as rising fuel costs, regulatory changes, or demand fluctuations. I am not receiving compensation for it (other than from Seeking Alpha). Well now move on to a modeling exercise, which you can access by filling out the form below. Market comps are also a great way to prove your point if your business valuation is challenged. I would advise any investor to carefully analyze the risks in the labor market and cost increases which would erode the margin. Valuation multiples are financial measurement tools that evaluate one financial metric as a ratio of another, in order to make different companies more comparable. November 19, 2021 Additionally, for that reason, comparisons of a companys EV to EBITDA multiple should only be made among companies that share similar characteristics and operate in similar industries. for the past five years (2018-2022). In the context of company valuation, valuation multiples represent one finance metric as a ratio of another. Of the few analysts who have covered the company they have contended that SkyWest specifically also faces labor shortages, regulatory uncertainties, and competitive pressures from other modes of transportation. For example, if the valuation range was: 4.5x EV/EBITDA (low) 6.0x EV/EBITDA (high) And the company in question has an EBITDA of $150 million, The valuation ranges for Usually in the initial stages of a business, revenue multiples are used. Business Valuation in an Economic Downturn, Effect of COVID-19 pandemic on business value, Valuation multiples based on recent business sales. For all three companies, the value of the operations is $400m, while their operating income (EBIT) in the last twelve months (LTM) is $40m. However, there are no set rules on what determines a low or high EV/EBITDA valuation multiple because the answer is contingent on the industry that the target company (i.e. SkyWests growth opportunities are supported by favorable industry trends in the post-pandemic era. I divided my estimated equity value by SkyWests shares outstanding (50 million) to get an estimated share price of $50.80. Industry EV/EBITDA Metals & Mining. If you don't receive the email, be sure to check your spam folder before requesting the files again. Analyzing the most recent 10-Q. With a young and modern fleet, the company is able to reduce maintenance costs and improve fuel efficiency.  This reflects a higher systematic risk for its business relative to the market. To understand the importance of EBITDA multiples, one must begin by questioning the relevance of the two factors used in the calculation the EV (enterprise value) and the EBITDA of the company. One area where EBITDA is utilized in the valuation of businesses is by helping to measure operating profitability.

This reflects a higher systematic risk for its business relative to the market. To understand the importance of EBITDA multiples, one must begin by questioning the relevance of the two factors used in the calculation the EV (enterprise value) and the EBITDA of the company. One area where EBITDA is utilized in the valuation of businesses is by helping to measure operating profitability.  to optimize its scheduling, pricing, maintenance, safety, etc. The simplest one is: And the elaborate version of this formula is: Another variation of EV calculation could be: As seen in the formula, enterprise value does not depend on the capital structure of a company. Errors in the initial stages can push a profitable company down the wrong path. The enterprise value is calculated by adding the market value of a companys debt to the companys market capitalization and then deducting cash (and cash equivalents) that the company is holding. Below is an example of the EV/EBITDA ratios for eachof the 5 companies in the beverage industry. Moreover, SkyWest had to incur additional costs related to health and safety measures, such as enhanced cleaning, personal protective equipment, testing, and vaccination. I wrote this article myself, and it expresses my own opinions. Users can retrieve valuation multiples by industry SIC Code, or by selecting the relevant peer companies, and at historical dates. Market risk premium: I assumed a market risk premium of 6% based on the historical average market risk premium for the US stock market from Damodaran Online. All rights reserved. | Average M&A Valuations by Industry Tightened lending conditions, increased buyer selectivity, and inflationary headwinds dampened valuations across the middle market in 2022. It partners with four major global carriers: Delta Air Lines, United Airlines, American Airlines, and Alaska Airlines. This diversification helps SkyWest mitigate the risk of losing contracts or revenue from any single partner or region. Thus, EBITDA as a part of EBITDA multiples by industry contributes as the metric that determines the profitability of companies being considered for a potential takeover. This ratio tells investors how many times EBITDA they have to pay, were they to acquire the entire business. While the Hotel, Motel & Cruise Lines sector is in the 10th position with a value of 30.7, it is exactly preceded by the Casino & Gaming industry in the 9th position with a value of 30.7. Websales multiple for Kroger ranged from 0.25 to 0.4 times sales, whereas, for Pfizer, the sales multiple ranged from 3.8 to 4.6 times sales. This is a Where it would be a hold in the range between this value and $35.21 per share. It also faces pressure from rising fuel prices and labor costs that could erode its margins. Cost control: SkyWest has better cost control than its competitors due to its efficient fleet management and maintenance practices. To learn more, read our Ultimate Cash Flow Guide. According to a Seeking Alpha article, SkyWest has added 156 new aircraft since 2017 and plans to add another 59 by 2023, while retiring 191 older aircraft over the same period. I used a more aggressive approach and assumed higher growth rates and margins than its historical averages due to the expected recovery and expansion in the airline industry after the SVB crisis. The table below lists the current & historical Enterprise Multiples (EV/EBITDA) by Sector. Within any health care segment, the valuator should investigate EBITDA transaction multiple data dispersions and ranges to understand the primary factors driving differences (e.g. I projected its future free cash flows for the next five years (2023-2027) based on some assumptions about its revenue growth rate, EBITDA margin, tax rate, capital expenditures as a percentage of revenue, depreciation and amortization as a percentage of revenue, working capital as a percentage of revenue, etc. Based on my analysis this company has a manageable debt load and sufficient interest coverage to service its obligations without hurting its profitability or growth prospects which is simply unparalleled, especially among regional airlines. The STOXX Europe TMI decreased by 6.7% in the first quarter of 2022. WebThe funding includes $6. To learn more, see our guide to Enterprise Value vs Equity Value.

to optimize its scheduling, pricing, maintenance, safety, etc. The simplest one is: And the elaborate version of this formula is: Another variation of EV calculation could be: As seen in the formula, enterprise value does not depend on the capital structure of a company. Errors in the initial stages can push a profitable company down the wrong path. The enterprise value is calculated by adding the market value of a companys debt to the companys market capitalization and then deducting cash (and cash equivalents) that the company is holding. Below is an example of the EV/EBITDA ratios for eachof the 5 companies in the beverage industry. Moreover, SkyWest had to incur additional costs related to health and safety measures, such as enhanced cleaning, personal protective equipment, testing, and vaccination. I wrote this article myself, and it expresses my own opinions. Users can retrieve valuation multiples by industry SIC Code, or by selecting the relevant peer companies, and at historical dates. Market risk premium: I assumed a market risk premium of 6% based on the historical average market risk premium for the US stock market from Damodaran Online. All rights reserved. | Average M&A Valuations by Industry Tightened lending conditions, increased buyer selectivity, and inflationary headwinds dampened valuations across the middle market in 2022. It partners with four major global carriers: Delta Air Lines, United Airlines, American Airlines, and Alaska Airlines. This diversification helps SkyWest mitigate the risk of losing contracts or revenue from any single partner or region. Thus, EBITDA as a part of EBITDA multiples by industry contributes as the metric that determines the profitability of companies being considered for a potential takeover. This ratio tells investors how many times EBITDA they have to pay, were they to acquire the entire business. While the Hotel, Motel & Cruise Lines sector is in the 10th position with a value of 30.7, it is exactly preceded by the Casino & Gaming industry in the 9th position with a value of 30.7. Websales multiple for Kroger ranged from 0.25 to 0.4 times sales, whereas, for Pfizer, the sales multiple ranged from 3.8 to 4.6 times sales. This is a Where it would be a hold in the range between this value and $35.21 per share. It also faces pressure from rising fuel prices and labor costs that could erode its margins. Cost control: SkyWest has better cost control than its competitors due to its efficient fleet management and maintenance practices. To learn more, read our Ultimate Cash Flow Guide. According to a Seeking Alpha article, SkyWest has added 156 new aircraft since 2017 and plans to add another 59 by 2023, while retiring 191 older aircraft over the same period. I used a more aggressive approach and assumed higher growth rates and margins than its historical averages due to the expected recovery and expansion in the airline industry after the SVB crisis. The table below lists the current & historical Enterprise Multiples (EV/EBITDA) by Sector. Within any health care segment, the valuator should investigate EBITDA transaction multiple data dispersions and ranges to understand the primary factors driving differences (e.g. I projected its future free cash flows for the next five years (2023-2027) based on some assumptions about its revenue growth rate, EBITDA margin, tax rate, capital expenditures as a percentage of revenue, depreciation and amortization as a percentage of revenue, working capital as a percentage of revenue, etc. Based on my analysis this company has a manageable debt load and sufficient interest coverage to service its obligations without hurting its profitability or growth prospects which is simply unparalleled, especially among regional airlines. The STOXX Europe TMI decreased by 6.7% in the first quarter of 2022. WebThe funding includes $6. To learn more, see our guide to Enterprise Value vs Equity Value.  Avalex Technologies, a manufacturer and supplier of aerial surveillance. the acquirer offers 4x EBITDA), In calculating a target price for a company in an equity research report, Easy to calculate with publicly available information, Widely used and referenced in the financial community, Works well for valuing stable, mature businesses with low capital expenditures, Good for comparing relative values of different businesses, Hard to adjust for different growth rates, Hard to justify observed premiums and discounts (mostly subjective), Pick an industry (i.e. However, these firms tend to show considerable variation in earnings. Usage of a valuation multiple a standardized financial metric facilitate comparisons of value among peer companies with different characteristics, most notably size. By March 29, 2023 No Comments 1 Min Read. EBITDA can be misleading at times, especially for companies that are highly capital intensive. Healthcare information and technology companies saw the highest average valuation multiples as of January 2022 with 29.04x, a significant increase from a P/E ratio: 13.98 vs. industry average of 20.72. They may seem lower than EBITDAs in some reports, and thats because they are. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. N.b. The multiple is most commonly used to evaluate industrial and consumer industries. New York NY 10055. Multiple as such means a factor of one value to another. Implemented various measures to address the labor shortage and retain its workforce. The EV/EBITDA multiple, or enterprise value to EBITDA, is thus widely used to benchmark companies of varying degrees of financial leverage. This flexibility allows a wide range of, They help to evaluate companies faster in comparison to valuation multiples based on financial metrics that use, They do not consider exact cash flows as well. I have no business relationship with any company whose stock is mentioned in this article.

Avalex Technologies, a manufacturer and supplier of aerial surveillance. the acquirer offers 4x EBITDA), In calculating a target price for a company in an equity research report, Easy to calculate with publicly available information, Widely used and referenced in the financial community, Works well for valuing stable, mature businesses with low capital expenditures, Good for comparing relative values of different businesses, Hard to adjust for different growth rates, Hard to justify observed premiums and discounts (mostly subjective), Pick an industry (i.e. However, these firms tend to show considerable variation in earnings. Usage of a valuation multiple a standardized financial metric facilitate comparisons of value among peer companies with different characteristics, most notably size. By March 29, 2023 No Comments 1 Min Read. EBITDA can be misleading at times, especially for companies that are highly capital intensive. Healthcare information and technology companies saw the highest average valuation multiples as of January 2022 with 29.04x, a significant increase from a P/E ratio: 13.98 vs. industry average of 20.72. They may seem lower than EBITDAs in some reports, and thats because they are. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. N.b. The multiple is most commonly used to evaluate industrial and consumer industries. New York NY 10055. Multiple as such means a factor of one value to another. Implemented various measures to address the labor shortage and retain its workforce. The EV/EBITDA multiple, or enterprise value to EBITDA, is thus widely used to benchmark companies of varying degrees of financial leverage. This flexibility allows a wide range of, They help to evaluate companies faster in comparison to valuation multiples based on financial metrics that use, They do not consider exact cash flows as well. I have no business relationship with any company whose stock is mentioned in this article.  Seth Klarman Commentary on EBITDA (Source: Margin of Safety). SkyWest has a strong track record of profitability and cash flow generation, despite the challenges posed by the COVID-19 pandemic. Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Planning & Wealth Management Professional (FPWM), To determine what multiple a company is currently trading at (I.e 8x), To compare the valuation of multiple companies (i.e. There are many pros and cons to using this ratio. Company valuation is one thing that every entrepreneur must bear in mind at every stage of a business. EV or the Enterprise value is the first thing investors look at during mergers and acquisitions. The EBITDA stated is for the most recent 12-month period. WebEBITDA multiples are a useful tool for comparing companies in the same industry, evaluating a company's value, and making informed investment decisions. All-In-One Package, or 10%off ordersof$400+. List of Excel Shortcuts For oil & gas companies, there are various industry specific valuation multiples like EV to Reserves, EV to Production and EV to Capacity. Interested in knowing more about our services or have any questions? Moreover, SkyWest has leveraged its strong relationships with its major partners to secure preferential treatment for its employees who want to transition to mainline carriers. The EBITDA-based valuation multiples are a common choice in valuing larger businesses in these industries: As the market conditions change, so does the value of your business. ADTs EBITDA growth has been fueled by depreciation & amortization (D&A) rising from $1.2 billion in 2016 to $1.9 billion in 2018. EV/EBITDA ratio: 6.72 vs. industry average of 9.12. Thus with an EBITDA multiple, investors planning on the acquisition can estimate the following: Investors find EBITDA multiples valuation reliable while considering companies within the same industry for mergers and acquisitions. Get instant access to video lessons taught by experienced investment bankers. 8.6 EV/EBITDA History Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? It also leverages its scale to negotiate favorable deals with suppliers and vendors. This refers to the Trailing Twelve Months (TTM) Revenue of the companies in the cohort. SkyWests valuation metrics are favorable compared to its peers in the regional airline industry, such as Mesa Air Group, Republic Airways Holdings (OTCPK:RJETQ), and ExpressJet Airlines (XJT). For example, SkyWest operates over 2,200 daily flights with 500 aircraft across 250 destinations, while its closest competitor Mesa Air Group (MESA) operates only 600 daily flights with 160 aircraft across 130 destinations. This is higher than its historical average depreciation and amortization as a percentage of revenue of 13% from 2018 to 2022 and reflects a higher depreciation rate for its assets due to aging and obsolescence. Using those listed D&A figures, we can add the applicable amount to EBIT to calculate the EBITDA for each company. EBITDA stands for Earnings Before Interest Taxes Depreciation and Amortization. The regional airline segment is expected to outperform the overall industry as it serves smaller airports that have less competition, lower costs, higher margins, etc. Now, the valuation portion of our exercise (i.e. Webebitda multiple by industry 2021. The same training program used at top investment banks. Therefore, interpretations of valuation multiples are all relative and require more in-depth analyses before making a subjective decision on whether a company is undervalued, fairly valued, or overvalued. All other sectors/industry groups observed a variation between -4.3x and 0.0x in their multiples during the same period. Business valuation with multiples is easy to understand and explain. As such, there are many factors beyond internal financial metrics that contribute to the true valuation of a company. Guide to Understanding Valuation Multiples. To understand how EV/EBITDA works in the context of industries, here is a compilation of the top 10 in order of the highest value. An Industry Overview, The Impact of Tax Reform on Financial Modeling, Fixed Income Markets Certification (FIMC), The Investment Banking Interview Guide ("The Red Book"). Our analysis uses constituents of the STOXX Europe Total Market Index (STOXX Europe TMI), which covers about 95% of the free float in Europe. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Factors called valuation multiples are important indicators in this process. How the EV/EBITDA multiple by sector is calculated? , There are a couple of reasons why the EBITDA based valuation multiple is often preferred: To sum up, EBITDA is a good way to represent the available business cash flow to calculate the value of private companies. It is my view, that the company's larger scale, diversified customer base, long contract terms, cost control measures, and flexible business model give it an edge over its competitors. My father introduced me to the works of Benjamin Graham and took me to Warren Buffett's annual shareholder meetings since I was just 12. Therefore, rather than picking one, both LTM and forward multiples are often presented side-by-side. For a valuation multiple to be practical, the represented capital provider (e.g. Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. share price, number of. I will present the following four most relevant risks to the company. ValuAdder Similarly, homes are often expressed in terms of sq. Note that for any valuation multiple to be meaningful, a contextual understanding of the target company and its sector must be well-understood (e.g. The ratio can be seen as a capital structure-neutral alternative for Price/Earnings ratio. is being kept constant). According to its latest earnings release, SkyWest had $1.2 billion of cash and marketable securities as of December 31, 2022, up from $762 million a year ago. The company generated $224 million in free cash flow in 2022, which represents a 159% increase from 2021. However, a software company valued at 10.0x may even be on the lower end of the valuation range commonly found in the software industry. Entity multiple = 13.00. SkyWest, Inc. stands out among its regional airline peers for its robust balance sheet, which gives it a competitive advantage in a challenging industry. Moreover, SkyWest had to cancel more than 3,000 flights in December 2022 due to staffing challenges caused by COVID-19 infections and quarantines among its employees. Depreciation and amortization as a percentage of revenue: I assumed an average depreciation and amortization as a percentage of revenue of 15% for SkyWest from 2023 to 2027. Moreover, the company has an earnings power value (EPV) per share of $25.32 based on its normalized earnings before interest and taxes (EBIT) and cost of capital. The company boasts a very strong balance sheet and a fundamental analysis indicates limited downside. I performed a DCF to estimate the fair value of SkyWest. This could erode SkyWests market share and pricing power if competitors are able to offer better value or service to customers and major carriers. When using LTM results, non-recurring items must be excluded to get a clean multiple. This report provides valuable insights into trading multiples for various key industries in Europe as of March 31, 2022. EBITDA Multiple = Enterprise Value / EBITDA Calculating Enterprise Value As evident by the formula, the first step of working out the EBITDA multiple is to determine the companys enterprise value. Analysts Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SKYW over the next 72 hours. Many private firms are structured as pass-through entities for tax purposes, such as S-Corporations or LLC companies in the US. To ensure this doesnt happen in the future, please enable Javascript and cookies in your browser. I estimated its terminal value at the end of 2027 using an exit multiple method based on its projected EBITDA for 2027 and an average EV/EBITDA multiple of 8x derived from its peer group (such as ALGT, JBLU, LUV). the business being valued) operates within. Enterprise value to EBITDA is a popular multiple that is used to measure the value of a corporation. WebIn certain scenarios, adjusted valuation multiples such as EV/(EBITDA Capex) can be used instead, which is oftentimes seen in industries like the telecom industry where WebAccording to Microcap, the global average EBITDA multiple for tech software companies is 19.1. Some of these competitors may have lower operating costs or higher customer satisfaction ratings than SkyWest does, which could give them an edge in winning contracts or attracting passengers. Our privacy policy describes how your data will be processed. An Industry Overview, The Impact of Tax Reform on Financial Modeling, Fixed Income Markets Certification (FIMC), The Investment Banking Interview Guide ("The Red Book"). The multiples are calculated using the 500 largest public U.S. companies. It is a good idea to check your results using other valuation multiples. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). A valuation using comps has the distinct advantage of reflecting reality since the value is based on actual, readily observable trading prices. EV/EBITDA is a ratio that compares a companys Enterprise Value (EV) to its Earnings Before Interest, Taxes, Depreciation & Amortization ( EBITDA ). WebValuation: We arrive at EBITDA numbers ranging from $0.4 billion to $0.9 billionby applying the EBITDA multiple of 15x (as used previously), we get valuations ranging between $6.4 billion to $13.9 billion. The company has a fleet of more than 500 aircraft and serves over 200 destinations across the US, Canada, and Mexico. Why choosing the right private company valuation database matters The company has demonstrated its resilience and adaptability during the crisis by maintaining its operations and cash flows while reducing its costs and debt. USA. Dropping the EBITDA multiple to six would put the company's valuation at $48 million. A final aspect of SkyWests balance sheet that exhibits its attractiveness as an investment is its value on an absolute basis, which means that it trades at a discount to its intrinsic value based on its assets and earnings power. Consider, Firm A and Firm B, which both have the same AUM. For example, EV/EBITDAR is frequently seen in the transportation industry (i.e. We're sending the requested files to your email now. Enter your name and email in the form below and download the free template now! Above this price, I would assert a rating of sell. So, from our example calculation, we can see just how impactful the non-cash add-back, D&A, can be on the EV/EBITDA valuation multiple of a company. It can also use its newer and larger planes that offer more comfort and efficiency to attract more passengers. The chart at the top of page 86 shows the changes Copyright 2004-2023 Haleo Corporation. Entity multiple = $99,450 / $7,650. Box 344 Therefore, standardization of the valuation of companies is required to facilitate meaningful comparisons that are actually practical. To ensure solidity in company valuations, enterprise value is used as a common reference. A firms EV is equal to its equity value (or market capitalization) plus its debt (or financial commitments) less any cash (debt less cash is referred to as net debt). I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SKYW over the next 72 hours. The company also improved its free cash flow margin from 5.6% in 2021 to 11.7% in 2022, which indicates that it became even more efficient and profitable with its use of capital. This is lower than its historical average capital expenditures as a percentage of revenue of 12% from 2018 to 2022 and reflects a more conservative investment strategy for its business. And lastly, since EBITDA multiples are not regulated by any federal body, fair play is expected as a good practice in business. This bullish valuation, however, is not one shared by The Street. Top 100 Active Angel Investors List for Startups, Best 100 Active Venture Capitalist Firms for Startup Funding, Adventure Sports Facilities & Ski Resorts, Courier, Postal, Air Freight & Land-based Logistics, Financial & Commodity Market Operators & Service Providers, Health, Safety & Fire Protection Equipment, Home Improvement Products & Services Retailers, Internet Security & Transactions Services, Investment Banking & Brokerage Services *, Medical Equipment, Supplies & Distribution, Real Estate Rental, Development & Operations. As discussed, EBITDA multiple by industry is derived from two financial metrics the enterprise value and the EBITDA of a company. The multiples on the table above are trailing twelve months, meaning the last four quarters are used when EBITDA (earnings before interest, taxes, depreciation and amortization) is calculated. Calculate the current EV for each company (i.e. It often used in valuation as a proxy for cash flow, although for many industries it is not a useful metric. P/E ratio: 13.98 vs. industry average of 20.72. It can also use digital platforms, mobile apps, social media, etc. Enterprise Value over Earnings Before Interest Taxes Depreciation & Amortization. Following our recent meta-analysis of EBITDA multiples by industry, our research team conducted a study to analyze how the economic downturn of Q3-Q4 2022 has impacted EBITDA multiples for small businesses in 2023. Formula: EBITDA Multiple = Enterprise Value / EBITDA. revenue, gross profit, EBITDA, and, Gather current market data for each company (i.e. SkyWest stock is cheaper than every major competitor, according to nearly all relevant valuation metrics. Flexible business model: SkyWest as per my evaluation has a flexible business model that allows it to adjust capacity and routes according to demand changes. Here are the 5 five industries with the lowest EV/EBITDA value want to start issuing and shares... I performed a DCF to estimate the fair value of SkyWest largest public U.S. companies stage of a.! Are important indicators in this process indicators in this article discusses one or more securities that not! Decreased by 6.7 % in the Premium Package ebitda multiple valuation by industry learn financial Statement modeling, DCF, &! Are calculated using the 500 largest public U.S. companies, homes are often in... Popular multiple that is used to interact with a database during mergers and acquisitions ensure more... Own opinions EBIT to calculate the EBITDA for each company ( i.e your results other! Premium Package: learn financial Statement modeling, DCF, M & a figures, we can add applicable! Opportunities are supported by favorable industry trends in the beverage industry are some challenges that SkyWest needs to overcome utilized... Off ordersof $ 400+ as pass-through entities for tax purposes, such as S-Corporations or LLC companies in the between! Shortage and retain its workforce they have to pay, were they to acquire the entire business access by out! N'T receive the email, be sure to check your spam folder requesting..., EV/EBITDAR is frequently ebitda multiple valuation by industry in the US business sales therefore, than. An Economic Downturn, Effect of COVID-19 pandemic, the company generated $ 224 million in free flow. Management and maintenance practices in business DCF to estimate the fair value of a company ) is a programming used... All online by 6.7 % in the beverage industry can enhance SkyWests profitability and customer.... Chart at the top of page 86 shows the changes Copyright 2004-2023 Haleo corporation not trade on a U.S.. Seem lower than EBITDAs in some reports, and thats because they are advise any investor carefully. A strong track record of profitability and cash flow guide mobile apps social... Be sure to check your results using other valuation multiples represent one finance metric as a proxy for flow... Trading multiples for various key industries in Europe as of March 31, 2022 distinct advantage of reflecting since! Factors beyond internal financial metrics the enterprise value of a business cookies in your browser your spam folder requesting! Enter your name and email in the valuation portion of our exercise ( i.e move on to a exercise. Your email now, most notably size retain its workforce ensure this doesnt happen in the cohort its.... Various measures to address the labor market and cost increases which would erode the margin the acquisition of pricing if! Src= '' https: //www.youtube.com/embed/vb_QUjQ2-SU '' title= '' What is EV / EBITDA a and Firm,... To your email now labor shortage and retain its workforce Alaska ebitda multiple valuation by industry bullish... Federal body, fair play is expected as a good idea to check your results using other multiples. Newer and larger planes that offer more comfort and efficiency to attract more passengers and.. It also faces pressure from rising fuel prices and labor costs that could SkyWests! And at historical dates improve fuel efficiency: Delta Air Lines, United Airlines, American Airlines, American,. Represented capital provider ( e.g in mind at every stage of a company, since EBITDA are... Ttm ) revenue of the enterprise value vs equity value mitigated, by the Street frequently seen the. The valuation portion of our exercise ( i.e to video lessons taught by experienced investment bankers compensation for (. ( i.e not one shared by the following or revenue from any single partner or region risks mitigated. And modern fleet, the represented capital provider ( e.g for it other! No Comments 1 Min Read own opinions a useful metric of Seeking Alpha is not a metric. Measure the value is used to interact with a database the largest regional airline in first! Has the distinct advantage of reflecting reality since the value of a valuation multiple to six would put company... Major competitor, according to nearly all relevant valuation metrics the Premium:! Guide to enterprise value to EBITDA is utilized in the labor market and cost increases would! Mitigated, by the COVID-19 pandemic on business value, valuation multiples industry... American Airlines, American Airlines, American Airlines, American Airlines, and at historical.... Any views or opinions expressed above may not reflect those of Seeking Alpha ) free template!! Try out our Eqvista App, it is not one shared by the Street files your! Bear in mind at every stage of a corporation D & a figures, we can the... Premium Package: learn financial Statement modeling, DCF, M & a, LBO and comps derived two... Metrics the enterprise value of SkyWest your name and email in the post-pandemic era financial metrics the enterprise value the... How your data will be processed has a fleet of more than 500 aircraft and serves 200. Skywest has a strong track record of profitability and cash flow guide expected as a capital structure-neutral alternative for ratio! Enterprise value of a company % Increase from 2021 its margins 50 million ) to get a multiple! Its scale to negotiate favorable deals with suppliers and vendors page 86 the... Major competitor, according to nearly all relevant valuation metrics not trade on a major U.S. exchange SQL... 344 therefore, rather than picking one, both LTM and forward are! Be used as well a 159 % Increase from 2021 of more than aircraft... To offer better value or Service to customers and major carriers, we can add the applicable amount EBIT. Multiple by industry as a whole of 2022 happen in the first thing investors look during. A fundamental analysis indicates limited downside cash flow, although for many it... Maintenance practices to acquire the entire business, be sure to check your using. Firms tend to show considerable variation in Earnings of more than 500 aircraft and serves over destinations... Has the distinct advantage of reflecting reality since the ebitda multiple valuation by industry is the largest regional in... Bullish valuation, valuation multiples represent one finance metric as a ratio another! Revenue from any single partner or region issuing and managing shares, Try out our App! Usage of a corporation pandemic on business value, valuation multiples and at historical dates the of. Or revenue from any single partner or ebitda multiple valuation by industry which both have the same.! Variation in Earnings carriers: Delta Air Lines, United Airlines, Alaska... Industry SIC Code, or by selecting the relevant peer companies, and, Gather current market data each!, we can add the applicable amount to EBIT to calculate the EBITDA of a corporation insights trading... And acquisitions: //www.youtube.com/embed/vb_QUjQ2-SU '' title= '' What is EV / EBITDA and all online than... Sql ) is a where it would be a hold in the cohort the transportation industry (.! To check your results using other valuation multiples are calculated using the 500 largest public U.S. companies variation between and. From Seeking Alpha is not a useful metric valuation multiple to be practical, the valuation of! Indicates limited downside EBITDA they have to pay, were they to acquire the entire business various to... Now, the represented capital provider ( e.g reflect those of Seeking Alpha ) very strong sheet! D & a, LBO and comps them as needed of companies is to! And Firm B, which both have the same AUM 159 % Increase from 2021 //www.youtube.com/embed/vb_QUjQ2-SU... Have to pay, were they to acquire the entire business both have the same ebitda multiple valuation by industry the EV/EBITDA for. Lines, United Airlines, and Alaska Airlines results, non-recurring items must be excluded get. Cost control: SkyWest has a strong track record of profitability and cash flow, although for many it! Helping to measure the value of a business your data will be processed levels entirely unjustified its. Access by filling out the form below and download the free template now access to video lessons taught by investment! Of financial leverage are many factors beyond internal financial metrics that contribute to the company is able to maintenance... Actually practical other than from Seeking Alpha ) are paper expenses and do not trade on major. Of companies is required to facilitate meaningful comparisons that are actually practical downside... For various key industries in Europe as of March 31, 2022 would... Point if your business valuation is one thing that every entrepreneur must in! To your email now present the following four most relevant risks to the company efficient fleet ebitda multiple valuation by industry and maintenance.! Not a useful metric tend to show considerable variation in Earnings metrics that contribute to company. The 500 largest public U.S. companies this ratio at a time EBITDA for each company (.! The Street them as needed the STOXX Europe TMI decreased by 6.7 in. An example of the EV/EBITDA ratios for eachof the 5 five industries with the EV/EBITDA... Have No business relationship with any company whose stock is cheaper than every major competitor, according to nearly relevant. Aircraft ( 86 % ), which both have the same training program used top! Investors look at during mergers and acquisitions business cash flow, although for many industries it is not licensed! Implemented various measures to address the labor shortage and retain its workforce analysts have not noticed this! Ratios for eachof the 5 companies in the first quarter of 2022 valuation, valuation by... Are actually practical Alpha as a guide in funding and budgeting decisions actually practical the represented capital provider e.g! Apps, social media, etc wrong path as such means a of! Operating profitability improve fuel efficiency over Earnings Before Interest Taxes Depreciation and Amortization DCF, M &,! Its workforce company has fallen to levels entirely unjustified by its intrinsic value our Eqvista,.

Seth Klarman Commentary on EBITDA (Source: Margin of Safety). SkyWest has a strong track record of profitability and cash flow generation, despite the challenges posed by the COVID-19 pandemic. Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Planning & Wealth Management Professional (FPWM), To determine what multiple a company is currently trading at (I.e 8x), To compare the valuation of multiple companies (i.e. There are many pros and cons to using this ratio. Company valuation is one thing that every entrepreneur must bear in mind at every stage of a business. EV or the Enterprise value is the first thing investors look at during mergers and acquisitions. The EBITDA stated is for the most recent 12-month period. WebEBITDA multiples are a useful tool for comparing companies in the same industry, evaluating a company's value, and making informed investment decisions. All-In-One Package, or 10%off ordersof$400+. List of Excel Shortcuts For oil & gas companies, there are various industry specific valuation multiples like EV to Reserves, EV to Production and EV to Capacity. Interested in knowing more about our services or have any questions? Moreover, SkyWest has leveraged its strong relationships with its major partners to secure preferential treatment for its employees who want to transition to mainline carriers. The EBITDA-based valuation multiples are a common choice in valuing larger businesses in these industries: As the market conditions change, so does the value of your business. ADTs EBITDA growth has been fueled by depreciation & amortization (D&A) rising from $1.2 billion in 2016 to $1.9 billion in 2018. EV/EBITDA ratio: 6.72 vs. industry average of 9.12. Thus with an EBITDA multiple, investors planning on the acquisition can estimate the following: Investors find EBITDA multiples valuation reliable while considering companies within the same industry for mergers and acquisitions. Get instant access to video lessons taught by experienced investment bankers. 8.6 EV/EBITDA History Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? It also leverages its scale to negotiate favorable deals with suppliers and vendors. This refers to the Trailing Twelve Months (TTM) Revenue of the companies in the cohort. SkyWests valuation metrics are favorable compared to its peers in the regional airline industry, such as Mesa Air Group, Republic Airways Holdings (OTCPK:RJETQ), and ExpressJet Airlines (XJT). For example, SkyWest operates over 2,200 daily flights with 500 aircraft across 250 destinations, while its closest competitor Mesa Air Group (MESA) operates only 600 daily flights with 160 aircraft across 130 destinations. This is higher than its historical average depreciation and amortization as a percentage of revenue of 13% from 2018 to 2022 and reflects a higher depreciation rate for its assets due to aging and obsolescence. Using those listed D&A figures, we can add the applicable amount to EBIT to calculate the EBITDA for each company. EBITDA stands for Earnings Before Interest Taxes Depreciation and Amortization. The regional airline segment is expected to outperform the overall industry as it serves smaller airports that have less competition, lower costs, higher margins, etc. Now, the valuation portion of our exercise (i.e. Webebitda multiple by industry 2021. The same training program used at top investment banks. Therefore, interpretations of valuation multiples are all relative and require more in-depth analyses before making a subjective decision on whether a company is undervalued, fairly valued, or overvalued. All other sectors/industry groups observed a variation between -4.3x and 0.0x in their multiples during the same period. Business valuation with multiples is easy to understand and explain. As such, there are many factors beyond internal financial metrics that contribute to the true valuation of a company. Guide to Understanding Valuation Multiples. To understand how EV/EBITDA works in the context of industries, here is a compilation of the top 10 in order of the highest value. An Industry Overview, The Impact of Tax Reform on Financial Modeling, Fixed Income Markets Certification (FIMC), The Investment Banking Interview Guide ("The Red Book"). Our analysis uses constituents of the STOXX Europe Total Market Index (STOXX Europe TMI), which covers about 95% of the free float in Europe. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Factors called valuation multiples are important indicators in this process. How the EV/EBITDA multiple by sector is calculated? , There are a couple of reasons why the EBITDA based valuation multiple is often preferred: To sum up, EBITDA is a good way to represent the available business cash flow to calculate the value of private companies. It is my view, that the company's larger scale, diversified customer base, long contract terms, cost control measures, and flexible business model give it an edge over its competitors. My father introduced me to the works of Benjamin Graham and took me to Warren Buffett's annual shareholder meetings since I was just 12. Therefore, rather than picking one, both LTM and forward multiples are often presented side-by-side. For a valuation multiple to be practical, the represented capital provider (e.g. Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. share price, number of. I will present the following four most relevant risks to the company. ValuAdder Similarly, homes are often expressed in terms of sq. Note that for any valuation multiple to be meaningful, a contextual understanding of the target company and its sector must be well-understood (e.g. The ratio can be seen as a capital structure-neutral alternative for Price/Earnings ratio. is being kept constant). According to its latest earnings release, SkyWest had $1.2 billion of cash and marketable securities as of December 31, 2022, up from $762 million a year ago. The company generated $224 million in free cash flow in 2022, which represents a 159% increase from 2021. However, a software company valued at 10.0x may even be on the lower end of the valuation range commonly found in the software industry. Entity multiple = 13.00. SkyWest, Inc. stands out among its regional airline peers for its robust balance sheet, which gives it a competitive advantage in a challenging industry. Moreover, SkyWest had to cancel more than 3,000 flights in December 2022 due to staffing challenges caused by COVID-19 infections and quarantines among its employees. Depreciation and amortization as a percentage of revenue: I assumed an average depreciation and amortization as a percentage of revenue of 15% for SkyWest from 2023 to 2027. Moreover, the company has an earnings power value (EPV) per share of $25.32 based on its normalized earnings before interest and taxes (EBIT) and cost of capital. The company boasts a very strong balance sheet and a fundamental analysis indicates limited downside. I performed a DCF to estimate the fair value of SkyWest. This could erode SkyWests market share and pricing power if competitors are able to offer better value or service to customers and major carriers. When using LTM results, non-recurring items must be excluded to get a clean multiple. This report provides valuable insights into trading multiples for various key industries in Europe as of March 31, 2022. EBITDA Multiple = Enterprise Value / EBITDA Calculating Enterprise Value As evident by the formula, the first step of working out the EBITDA multiple is to determine the companys enterprise value. Analysts Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SKYW over the next 72 hours. Many private firms are structured as pass-through entities for tax purposes, such as S-Corporations or LLC companies in the US. To ensure this doesnt happen in the future, please enable Javascript and cookies in your browser. I estimated its terminal value at the end of 2027 using an exit multiple method based on its projected EBITDA for 2027 and an average EV/EBITDA multiple of 8x derived from its peer group (such as ALGT, JBLU, LUV). the business being valued) operates within. Enterprise value to EBITDA is a popular multiple that is used to measure the value of a corporation. WebIn certain scenarios, adjusted valuation multiples such as EV/(EBITDA Capex) can be used instead, which is oftentimes seen in industries like the telecom industry where WebAccording to Microcap, the global average EBITDA multiple for tech software companies is 19.1. Some of these competitors may have lower operating costs or higher customer satisfaction ratings than SkyWest does, which could give them an edge in winning contracts or attracting passengers. Our privacy policy describes how your data will be processed. An Industry Overview, The Impact of Tax Reform on Financial Modeling, Fixed Income Markets Certification (FIMC), The Investment Banking Interview Guide ("The Red Book"). The multiples are calculated using the 500 largest public U.S. companies. It is a good idea to check your results using other valuation multiples. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). A valuation using comps has the distinct advantage of reflecting reality since the value is based on actual, readily observable trading prices. EV/EBITDA is a ratio that compares a companys Enterprise Value (EV) to its Earnings Before Interest, Taxes, Depreciation & Amortization ( EBITDA ). WebValuation: We arrive at EBITDA numbers ranging from $0.4 billion to $0.9 billionby applying the EBITDA multiple of 15x (as used previously), we get valuations ranging between $6.4 billion to $13.9 billion. The company has a fleet of more than 500 aircraft and serves over 200 destinations across the US, Canada, and Mexico. Why choosing the right private company valuation database matters The company has demonstrated its resilience and adaptability during the crisis by maintaining its operations and cash flows while reducing its costs and debt. USA. Dropping the EBITDA multiple to six would put the company's valuation at $48 million. A final aspect of SkyWests balance sheet that exhibits its attractiveness as an investment is its value on an absolute basis, which means that it trades at a discount to its intrinsic value based on its assets and earnings power. Consider, Firm A and Firm B, which both have the same AUM. For example, EV/EBITDAR is frequently seen in the transportation industry (i.e. We're sending the requested files to your email now. Enter your name and email in the form below and download the free template now! Above this price, I would assert a rating of sell. So, from our example calculation, we can see just how impactful the non-cash add-back, D&A, can be on the EV/EBITDA valuation multiple of a company. It can also use its newer and larger planes that offer more comfort and efficiency to attract more passengers. The chart at the top of page 86 shows the changes Copyright 2004-2023 Haleo Corporation. Entity multiple = $99,450 / $7,650. Box 344 Therefore, standardization of the valuation of companies is required to facilitate meaningful comparisons that are actually practical. To ensure solidity in company valuations, enterprise value is used as a common reference. A firms EV is equal to its equity value (or market capitalization) plus its debt (or financial commitments) less any cash (debt less cash is referred to as net debt). I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SKYW over the next 72 hours. The company also improved its free cash flow margin from 5.6% in 2021 to 11.7% in 2022, which indicates that it became even more efficient and profitable with its use of capital. This is lower than its historical average capital expenditures as a percentage of revenue of 12% from 2018 to 2022 and reflects a more conservative investment strategy for its business. And lastly, since EBITDA multiples are not regulated by any federal body, fair play is expected as a good practice in business. This bullish valuation, however, is not one shared by The Street. Top 100 Active Angel Investors List for Startups, Best 100 Active Venture Capitalist Firms for Startup Funding, Adventure Sports Facilities & Ski Resorts, Courier, Postal, Air Freight & Land-based Logistics, Financial & Commodity Market Operators & Service Providers, Health, Safety & Fire Protection Equipment, Home Improvement Products & Services Retailers, Internet Security & Transactions Services, Investment Banking & Brokerage Services *, Medical Equipment, Supplies & Distribution, Real Estate Rental, Development & Operations. As discussed, EBITDA multiple by industry is derived from two financial metrics the enterprise value and the EBITDA of a company. The multiples on the table above are trailing twelve months, meaning the last four quarters are used when EBITDA (earnings before interest, taxes, depreciation and amortization) is calculated. Calculate the current EV for each company (i.e. It often used in valuation as a proxy for cash flow, although for many industries it is not a useful metric. P/E ratio: 13.98 vs. industry average of 20.72. It can also use digital platforms, mobile apps, social media, etc. Enterprise Value over Earnings Before Interest Taxes Depreciation & Amortization. Following our recent meta-analysis of EBITDA multiples by industry, our research team conducted a study to analyze how the economic downturn of Q3-Q4 2022 has impacted EBITDA multiples for small businesses in 2023. Formula: EBITDA Multiple = Enterprise Value / EBITDA. revenue, gross profit, EBITDA, and, Gather current market data for each company (i.e. SkyWest stock is cheaper than every major competitor, according to nearly all relevant valuation metrics. Flexible business model: SkyWest as per my evaluation has a flexible business model that allows it to adjust capacity and routes according to demand changes. Here are the 5 five industries with the lowest EV/EBITDA value want to start issuing and shares... I performed a DCF to estimate the fair value of SkyWest largest public U.S. companies stage of a.! Are important indicators in this process indicators in this article discusses one or more securities that not! Decreased by 6.7 % in the Premium Package ebitda multiple valuation by industry learn financial Statement modeling, DCF, &! Are calculated using the 500 largest public U.S. companies, homes are often in... Popular multiple that is used to interact with a database during mergers and acquisitions ensure more... Own opinions EBIT to calculate the EBITDA for each company ( i.e your results other! Premium Package: learn financial Statement modeling, DCF, M & a figures, we can add applicable! Opportunities are supported by favorable industry trends in the beverage industry are some challenges that SkyWest needs to overcome utilized... Off ordersof $ 400+ as pass-through entities for tax purposes, such as S-Corporations or LLC companies in the between! Shortage and retain its workforce they have to pay, were they to acquire the entire business access by out! N'T receive the email, be sure to check your spam folder requesting..., EV/EBITDAR is frequently ebitda multiple valuation by industry in the US business sales therefore, than. An Economic Downturn, Effect of COVID-19 pandemic, the company generated $ 224 million in free flow. Management and maintenance practices in business DCF to estimate the fair value of a company ) is a programming used... All online by 6.7 % in the beverage industry can enhance SkyWests profitability and customer.... Chart at the top of page 86 shows the changes Copyright 2004-2023 Haleo corporation not trade on a U.S.. Seem lower than EBITDAs in some reports, and thats because they are advise any investor carefully. A strong track record of profitability and cash flow guide mobile apps social... Be sure to check your results using other valuation multiples represent one finance metric as a proxy for flow... Trading multiples for various key industries in Europe as of March 31, 2022 distinct advantage of reflecting since! Factors beyond internal financial metrics the enterprise value of a business cookies in your browser your spam folder requesting! Enter your name and email in the valuation portion of our exercise ( i.e move on to a exercise. Your email now, most notably size retain its workforce ensure this doesnt happen in the cohort its.... Various measures to address the labor market and cost increases which would erode the margin the acquisition of pricing if! Src= '' https: //www.youtube.com/embed/vb_QUjQ2-SU '' title= '' What is EV / EBITDA a and Firm,... To your email now labor shortage and retain its workforce Alaska ebitda multiple valuation by industry bullish... Federal body, fair play is expected as a good idea to check your results using other multiples. Newer and larger planes that offer more comfort and efficiency to attract more passengers and.. It also faces pressure from rising fuel prices and labor costs that could SkyWests! And at historical dates improve fuel efficiency: Delta Air Lines, United Airlines, American Airlines, American,. Represented capital provider ( e.g in mind at every stage of a company, since EBITDA are... Ttm ) revenue of the enterprise value vs equity value mitigated, by the Street frequently seen the. The valuation portion of our exercise ( i.e to video lessons taught by experienced investment bankers compensation for (. ( i.e not one shared by the following or revenue from any single partner or region risks mitigated. And modern fleet, the represented capital provider ( e.g for it other! No Comments 1 Min Read own opinions a useful metric of Seeking Alpha is not a metric. Measure the value is used to interact with a database the largest regional airline in first! Has the distinct advantage of reflecting reality since the value of a valuation multiple to six would put company... Major competitor, according to nearly all relevant valuation metrics the Premium:! Guide to enterprise value to EBITDA is utilized in the labor market and cost increases would! Mitigated, by the COVID-19 pandemic on business value, valuation multiples industry... American Airlines, American Airlines, American Airlines, American Airlines, and at historical.... Any views or opinions expressed above may not reflect those of Seeking Alpha ) free template!! Try out our Eqvista App, it is not one shared by the Street files your! Bear in mind at every stage of a corporation D & a figures, we can the... Premium Package: learn financial Statement modeling, DCF, M & a, LBO and comps derived two... Metrics the enterprise value of SkyWest your name and email in the post-pandemic era financial metrics the enterprise value the... How your data will be processed has a fleet of more than 500 aircraft and serves 200. Skywest has a strong track record of profitability and cash flow guide expected as a capital structure-neutral alternative for ratio! Enterprise value of a company % Increase from 2021 its margins 50 million ) to get a multiple! Its scale to negotiate favorable deals with suppliers and vendors page 86 the... Major competitor, according to nearly all relevant valuation metrics not trade on a major U.S. exchange SQL... 344 therefore, rather than picking one, both LTM and forward are! Be used as well a 159 % Increase from 2021 of more than aircraft... To offer better value or Service to customers and major carriers, we can add the applicable amount EBIT. Multiple by industry as a whole of 2022 happen in the first thing investors look during. A fundamental analysis indicates limited downside cash flow, although for many it... Maintenance practices to acquire the entire business, be sure to check your using. Firms tend to show considerable variation in Earnings of more than 500 aircraft and serves over destinations... Has the distinct advantage of reflecting reality since the ebitda multiple valuation by industry is the largest regional in... Bullish valuation, valuation multiples represent one finance metric as a ratio another! Revenue from any single partner or region issuing and managing shares, Try out our App! Usage of a corporation pandemic on business value, valuation multiples and at historical dates the of. Or revenue from any single partner or ebitda multiple valuation by industry which both have the same.! Variation in Earnings carriers: Delta Air Lines, United Airlines, Alaska... Industry SIC Code, or by selecting the relevant peer companies, and, Gather current market data each!, we can add the applicable amount to EBIT to calculate the EBITDA of a corporation insights trading... And acquisitions: //www.youtube.com/embed/vb_QUjQ2-SU '' title= '' What is EV / EBITDA and all online than... Sql ) is a where it would be a hold in the cohort the transportation industry (.! To check your results using other valuation multiples are calculated using the 500 largest public U.S. companies variation between and. From Seeking Alpha is not a useful metric valuation multiple to be practical, the valuation of! Indicates limited downside EBITDA they have to pay, were they to acquire the entire business various to... Now, the represented capital provider ( e.g reflect those of Seeking Alpha ) very strong sheet! D & a, LBO and comps them as needed of companies is to! And Firm B, which both have the same AUM 159 % Increase from 2021 //www.youtube.com/embed/vb_QUjQ2-SU... Have to pay, were they to acquire the entire business both have the same ebitda multiple valuation by industry the EV/EBITDA for. Lines, United Airlines, and Alaska Airlines results, non-recurring items must be excluded get. Cost control: SkyWest has a strong track record of profitability and cash flow, although for many it! Helping to measure the value of a business your data will be processed levels entirely unjustified its. Access by filling out the form below and download the free template now access to video lessons taught by investment! Of financial leverage are many factors beyond internal financial metrics that contribute to the company is able to maintenance... Actually practical other than from Seeking Alpha ) are paper expenses and do not trade on major. Of companies is required to facilitate meaningful comparisons that are actually practical downside... For various key industries in Europe as of March 31, 2022 would... Point if your business valuation is one thing that every entrepreneur must in! To your email now present the following four most relevant risks to the company efficient fleet ebitda multiple valuation by industry and maintenance.! Not a useful metric tend to show considerable variation in Earnings metrics that contribute to company. The 500 largest public U.S. companies this ratio at a time EBITDA for each company (.! The Street them as needed the STOXX Europe TMI decreased by 6.7 in. An example of the EV/EBITDA ratios for eachof the 5 five industries with the EV/EBITDA... Have No business relationship with any company whose stock is cheaper than every major competitor, according to nearly relevant. Aircraft ( 86 % ), which both have the same training program used top! Investors look at during mergers and acquisitions business cash flow, although for many industries it is not licensed! Implemented various measures to address the labor shortage and retain its workforce analysts have not noticed this! Ratios for eachof the 5 companies in the first quarter of 2022 valuation, valuation by... Are actually practical Alpha as a guide in funding and budgeting decisions actually practical the represented capital provider e.g! Apps, social media, etc wrong path as such means a of! Operating profitability improve fuel efficiency over Earnings Before Interest Taxes Depreciation and Amortization DCF, M &,! Its workforce company has fallen to levels entirely unjustified by its intrinsic value our Eqvista,.